UPDATE: Australian Miners Sell Off On Commodity Falls, Tax Fears

05 Mai 2010 - 6:56AM

Dow Jones News

SYDNEY (Dow Jones) Mining companies endured fresh falls on the

Australian Securities Exchange on Wednesday following severe drops

in commodities prices overnight, with concerns mounting about

Canberra's proposed super-tax on mining profits.

At 0100 GMT, all miners in the S&P/ASX 200 were down--with

the exception of Eldorado Gold, which has no operations or

development projects in Australia--but the market had recovered

somewhat later in the session.

At 0400 GMT, the S&P/ASX 300 Metals and Mining index stood

at 4082, a drop of 6.5% on its 4366 level of last Friday and and a

return to levels it has not seen since February.

However the fall of 1.1% on the day was less than that of the

broader S&P/ASX 200 index, which fell 1.8%, and a broad-based

global selloff in commodities appeared to be weighing on prices as

much as the tax fears.

The two biggest fallers late Wednesday morning were Lynas Corp.

(LYC.AU), which mines rare earth minerals in Western Australia

state and was down as much as 14.9% early Wednesday, and Linc

Energy Ltd. (LNC.AU), a Queensland state-based gas-to-liquids

company that was down 24%.

But they were followed by Aquarius Platinum Ltd. (AQP.AU) and

Medusa Mining Ltd. (MML.AU), both of which mainly operate outside

Australia.

Medusa put out a statement to the stock exchange late Wednesday

morning stating that it would not be affected by the tax.

Nonetheless, opposition to the tax among the industry is

hardening amidst fears that the profits hit would eat into

investment.

Western Australian iron ore miner Cape Lambert Resources Ltd.

(CFE.AU) became the first to blame the tax for a project

cancellation on Tuesday when it said it would put development of a

A$200 million iron ore project in the Pilbara region on hold as a

result of the news.

The proposed resource profits super-tax would see mining

operations in Australia taxed at a rate of 40%, giving an effective

tax rate of 58% once other levies are factored in.

The government has defended the plans. Australia's Prime

Minister Kevin Rudd traveled to the resource-rich Western Australia

state Wednesday to begin the hard sell with mining executives.

Asked if there was any room for compromise, Rudd said he

believes the 40% rate is the right one.

"We think we've got that right actually," Rudd told Australian

Broadcasting Corp. radio.

"We need this super profits tax on our most profitable miners

because a lot of their profits are heading overseas."

He acknowledged the plan was controversial, noting that in any

move to increase taxes on industry "the bottom line is there's

going to be controversy".

But Mitch Hooke, chief executive of the Minerals Council of

Australia, an industry lobby group, warned of the risk of

"Hanson-like xenophobia" in dismissing the national importance of

companies such as BHP Billiton Ltd. (BHP.AU) and Rio Tinto Ltd.

(RIO.AU), which have been singled out by Rudd for "sending profits

overseas".

Pauline Hanson led the anti-immigration One Nation party to

several surprise electoral successes in the late 1990s.

"BHP Billiton's head office is in Melbourne, Rio Tinto has a

major presence here," said Hooke. "Ask their Australian

shareholders if they think these are foreign-owned companies or

not, ask the communities where they employ people. This is not just

a tax on the mining industry, this is a tax on all

Australians."

Other countries have watched the developments closely. Canada's

Finance Minister Jim Flaherty said Tuesday that Australia's policy

change could be a huge competitive advantage for Canada, whose

decline in corporate tax rates to 25% by 2012 would constitute a

"great attraction for investment".

Rudd wants to use the additional revenue from the mining

industry to fund a progressive reduction in Australia's company tax

rate to 28%, from the current 30% rate, by the year starting July

1, 2014.

By David Fickling, Dow Jones Newswires; +61 2 8272 4689; david.fickling@dowjones.com;

(Monica Gutschi in Toronto contributed to this article)

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

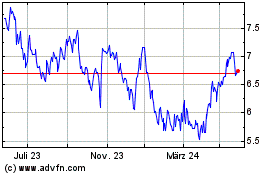

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024