UPDATE: Shell/PetroChina A$3.44 Billion Bid For Arrow Gets FIRB Nod

30 April 2010 - 8:43AM

Dow Jones News

Arrow Energy Ltd. (AOE.AU) said Friday that Australian

regulators have approved Royal Dutch Shell Plc (RDSB.LN) and

PetroChina Co. Ltd.'s (PTR) A$3.44 billion bid for the company,

paving the way for China's biggest direct investment in Australia's

booming coal seam gas sector.

In a statement, Arrow said Foreign Investment Review Board

approval of the deal, which follows clearance by the Australian

competition regulator earlier this month, means the joint venture

can now seek regulatory approval from Chinese authorities.

FIRB's approval shows that Australia remains open to Chinese

investment in its natural resources sector and is broadly in line

with FIRB's view, expressed last year, that Australia is more

comfortable with foreign investments by state-owned entities below

50% in new projects and below 15% in major producers.

PetroChina will end up with 50% of Arrow, a relatively small

company in Australia's resources sector, and participate in Royal

Dutch Shell's plan to build a large liquefied natural gas project

using Arrow's gas at the port of Gladstone in Queensland state.

Australian companies Origin Energy Ltd. (ORG.AU) and Santos Ltd.

(STO.AU) already have a large foothold in the coal seam gas sector

though LNG joint ventures in Queensland with ConocoPhillips (COP)

and Malaysia's Petroliam Nasional Bhd. (PET.YY).

Arrow said it is still on target to hold a shareholder meeting

to consider the scheme in mid-July. A rejection by shareholders is

unlikely, given it would send Arrow shares plummeting and biggest

shareholder New Hope Corp. Ltd. (NHC.AU) has indicated it will

support the deal.

China National Offshore Oil Corp. recently agreed to take a 10%

stake in BG Group Plc's (BG.LN) proposed LNG terminal in Queensland

and a 5% stake in an associated coal seam gas field.

Outside the coal seam gas sector, Australia last year granted

conditional approval for a A$3.54 billion takeover of coal miner

Felix Resources Ltd. by Yanzhou Coal Mining Co., marking the

largest Chinese takeover of an Australian company.

In securing approval, Yanzhou agreed to hold the assets in an

Australian-based company and list that company on Australia's stock

market by the end of 2012, by which time it will reduce its

ownership to below 70%.

Australia's decision to approve the Felix deal contrasted with

FIRB's move last year to reject a Chinese company's offer to take

control of rare-earths miner Lynas Corp. (LYC.AU).

Lynas was proposing to build the biggest new rare-earths mine in

the world and China already controls about 95% of global

rare-earths production.

FIRB typically doesn't release an explanation for its decisions

and a FIRB spokesman declined to comment.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

bill.lindsay@dowjones.com

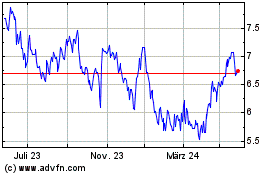

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024