NBT Bancorp Inc. (“NBT”) (NASDAQ: NBTB) and Evans Bancorp, Inc.

(“Evans”) (NYSE American: EVBN) today announced they have entered

into a definitive agreement pursuant to which Evans will merge with

and into NBT. This merger will bring together two highly respected

banking companies and extend NBT’s growing footprint into Western

New York.

“We are enthusiastic about this opportunity to partner with

Evans and are confident it is a high quality and incredibly

impactful way to expand NBT’s presence into Western New York,” said

NBT President and Chief Executive Officer Scott A. Kingsley.

“Adding the greater Buffalo and Rochester communities to the

markets served by NBT is a natural geographic extension of our

footprint in Upstate New York where we have been very active and

successful for nearly 170 years. We share strong community banking

values with Evans and look forward to working with their

experienced team to build on the relationships they have

established with their customers, communities and

shareholders.”

The combined organization will have the highest deposit market

share in Upstate New York for any bank with assets under $100

billion and will result in a network of over 170 locations from

Buffalo, NY to Portland, ME.

NBT’s primary subsidiary, NBT Bank, N.A., has 154 locations in

seven northeastern states. With 107 of those locations in Upstate

New York, NBT’s banking franchise currently stretches west to east

from Syracuse to the Capital District and north to south from

Plattsburgh to Binghamton and the Hudson Valley. Evans,

headquartered in Williamsville, NY had assets of $2.26 billion as

of June 30, 2024, and 18 locations in the Buffalo and Rochester

markets.

Pursuant to the merger agreement, NBT will acquire 100% of the

outstanding shares of Evans in exchange for common shares of NBT.

The exchange ratio will be fixed at 0.91 NBT shares for each share

of Evans, resulting in an aggregate transaction value of

approximately $236 million based on NBT’s closing stock price of

$46.28 on September 6, 2024. The merger was unanimously approved by

the Boards of Directors of both companies.

“We are very excited to be joining the NBT family and bringing

the next generation of community banking to Buffalo, Rochester and

the Finger Lakes,” said David J. Nasca, Evans President and Chief

Executive Officer. “We believe this strategic merger offers

customers and the communities we serve access to elevated financial

products and relationships with a combined organization that has

consistently received recognition for delivering outstanding

service while creating tremendous value for shareholders. NBT is

strongly committed to upholding our relationship-focused approach

and providing a significant suite of expanded products, services

and capabilities, including technology-enabled solutions, delivered

by the professionals our customers and markets have trusted. In NBT

we have found a powerful partner that closely mirrors the culture

and values that we have operated under throughout our long

history.” Mr. Nasca will join the NBT Board of Directors following

the merger.

The merger is expected to close in the second quarter of 2025,

subject to the satisfaction of customary closing conditions,

including approval by the shareholders of Evans and the receipt of

required regulatory approvals.

Stephens Inc. served as financial advisor to NBT, and Piper

Sandler & Co. served as financial advisor to Evans. Hogan

Lovells US LLP served as legal counsel to NBT, Wiggin and Dana LLP

served as executive compensation and employee benefits counsel to

NBT, and Luse Gorman, PC served as legal counsel to Evans.

Investor CallNBT will host a conference call at

10:00 a.m. (Eastern) on Tuesday, September 10, 2024, to discuss the

combination with Evans. The audio webcast link, along with the

corresponding presentation slides, will be available on NBT’s Event

Calendar page at

https://www.nbtbancorp.com/bn/presentations-events.html#events and

will be archived for twelve months.

About NBT Bancorp Inc.NBT Bancorp Inc. is

a financial holding company headquartered in Norwich, NY, with

total assets of $13.50 billion at June 30, 2024. NBT

primarily operates through NBT Bank, N.A., a full-service

community bank, and through two financial services

companies. NBT Bank, N.A. has 154 banking locations

in New

York, Pennsylvania, Vermont, Massachusetts, New

Hampshire, Maine and Connecticut. EPIC Retirement

Plan Services, based in Rochester, NY, is a national benefits

administration firm. NBT Insurance Agency, LLC, based

in Norwich, NY, is a full-service insurance agency. More

information about NBT and its divisions is available online at

www.nbtbancorp.com, www.nbtbank.com, www.epicrps.com and

https://www.nbtbank.com/insurance.

About Evans Bancorp, Inc.Evans is a financial

holding company headquartered in Williamsville, NY, with total

assets of $2.26 billion at June 30, 2024. Its primary subsidiary,

Evans Bank, N.A., is a full-service community bank with 18 branches

providing comprehensive financial services to consumer, business

and municipal customers throughout Western New York. More

information about Evans is available online at www.evansbancorp.com

and www.evansbank.com.

Forward-Looking StatementsThis communication

contains forward-looking statements as defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements about NBT and Evans and their industry involve

substantial risks and uncertainties. Statements other than

statements of current or historical fact, including statements

regarding NBT’s or Evans’ future financial condition, results of

operations, business plans, liquidity, cash flows, projected costs,

and the impact of any laws or regulations applicable to NBT or

Evans, are forward-looking statements. Words such as “anticipates,”

“believes,” “estimates,” “expects,” “forecasts,” “intends,”

“plans,” “projects,” “may,” “will,” “should” and other similar

expressions are intended to identify these forward-looking

statements. Such statements are subject to factors that could cause

actual results to differ materially from anticipated results.

Among the risks and uncertainties that could cause actual

results to differ from those described in the forward-looking

statements include, but are not limited to the following: (1) the

businesses of NBT and Evans may not be combined successfully, or

such combination may take longer to accomplish than expected; (2)

the cost savings from the merger may not be fully realized or may

take longer to realize than expected; (3) operating costs, customer

loss and business disruption following the merger, including

adverse effects on relationships with employees, may be greater

than expected; (4) governmental approvals of the merger may not be

obtained, or adverse regulatory conditions may be imposed in

connection with governmental approvals of the merger; (5) the

shareholders of Evans may fail to approve the merger; (6) the

possibility that the merger may be more expensive to complete than

anticipated, including as a result of unexpected factors or events;

(7) diversion of management’s attention from ongoing business

operations and opportunities; (8) the possibility that the parties

may be unable to achieve expected synergies and operating

efficiencies in the merger within the expected timeframes or at all

and to successfully integrate Evans’ operations and those of NBT;

(9) such integration may be more difficult, time consuming or

costly than expected; (10) revenues following the proposed

transaction may be lower than expected; (11) NBT’s and Evans’

success in executing their respective business plans and strategies

and managing the risks involved in the foregoing; (12) the dilution

caused by NBT’s issuance of additional shares of its capital stock

in connection with the proposed transaction; (13) changes in

general economic conditions, including changes in market interest

rates and changes in monetary and fiscal policies of the federal

government; and (14) legislative and regulatory changes. Further

information about these and other relevant risks and uncertainties

may be found in NBT’s and Evans’ respective Annual Reports on Form

10-K for the fiscal year ended December 31, 2023 and in subsequent

filings with the Securities and Exchange Commission (“SEC”).

Forward-looking statements speak only as of the date they are

made. NBT and Evans do not undertake, and specifically disclaim any

obligation, to publicly release the result of any revisions which

may be made to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements. You are cautioned not to place

undue reliance on these forward-looking statements.

Additional Information and Where to Find ItIn

connection with the proposed transaction, NBT expects to file with

the SEC a registration statement on Form S-4 that will include a

proxy statement of Evans and a prospectus of NBT (the “proxy

statement/prospectus”), which proxy statement/prospectus will be

mailed or otherwise disseminated to Evans’ shareholders when it

becomes available. NBT and Evans also plan to file other relevant

documents with the SEC regarding the proposed transaction.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT ON FORM S-4, THE PROXY STATEMENT/PROSPECTUS TO BE

INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4, AND ANY

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC WHEN

THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT NBT, EVANS AND THE PROPOSED TRANSACTION. You may obtain a

free copy of the registration statement, including the proxy

statement/prospectus (when it becomes available) and other relevant

documents filed by NBT and Evans with the SEC, without charge, at

the SEC’s website at www.sec.gov. Copies of the documents filed by

NBT with the SEC will be available free of charge on NBT’s website

at www.nbtbancorp.com or by directing a request to NBT Bancorp

Inc., 52 South Broad Street, Norwich, NY 13815, attention:

Corporate Secretary, telephone (607) 337-6141. Copies of the

documents filed by Evans with the SEC will be available free of

charge on Evans’ website at www.evansbancorp.com or by directing a

request to Evans Bancorp, Inc., 6460 Main Street, Williamsville, NY

14221, attention: Secretary, telephone (716) 926-2000.

No OfferThis communication does not constitute

an offer to sell or the solicitation of an offer to buy any

securities. No offering of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, and otherwise in accordance

with applicable law.

Participants in the SolicitationNBT AND EVANS

AND THEIR RESPECTIVE DIRECTORS AND EXECUTIVE OFFICERS AND OTHER

MEMBERS OF MANAGEMENT AND EMPLOYEES MAY BE DEEMED TO BE

PARTICIPANTS IN THE SOLICITATION OF PROXIES IN RESPECT OF THE

PROPOSED TRANSACTION. YOU CAN FIND INFORMATION ABOUT NBT’S

EXECUTIVE OFFICERS AND DIRECTORS IN NBT’S DEFINITIVE PROXY

STATEMENT FILED WITH THE SEC ON APRIL 5, 2024. YOU CAN FIND

INFORMATION ABOUT EVANS’ EXECUTIVE OFFICERS AND DIRECTORS IN EVANS’

DEFINITIVE PROXY STATEMENT FILED WITH THE SEC ON MARCH 25, 2024.

ADDITIONAL INFORMATION REGARDING THE INTERESTS OF SUCH POTENTIAL

PARTICIPANTS WILL BE INCLUDED IN THE PROXY STATEMENT/PROSPECTUS AND

OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME

AVAILABLE. YOU MAY OBTAIN FREE COPIES OF THESE DOCUMENTS FROM NBT

OR EVANS USING THE SOURCES INDICATED ABOVE.

| Contacts |

NBT Bancorp

Inc. |

Evans Bancorp,

Inc. |

| |

Scott A. KingsleyPresident and

Chief Executive Officer |

David J. NascaPresident and

Chief Executive Officer |

| |

Annette L. BurnsEVP and Chief

Financial Officer |

John B. ConnertonEVP and Chief

Financial Officer |

| |

607-337-6589 |

716-926-2000 |

| |

|

Evans Investor

RelationsDeborah K. Pawlowski, Kei

Advisorsdpawlowski@keiadvisors.com716-843-3908 |

This press release was published by a CLEAR® Verified

individual.

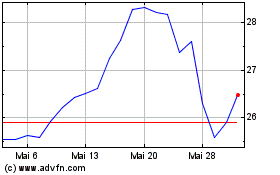

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

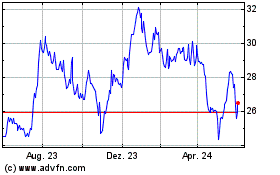

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024