LONDON MARKETS: FTSE 100 Wavers Around 5-week High As Data Show Wages Still Under Pressure

13 Dezember 2017 - 12:20PM

Dow Jones News

By Carla Mozee, MarketWatch

Interest rate increase expected from U.S. Federal Reserve

U.K. stocks searched for direction Wednesday, with the blue-chip

index hovering around its highest level in more than a month.

Equities were largely unchanged after a monthly update on U.K.

jobs and wages.

How markets moved: The FTSE 100 index was up 1 point at

7,501.65, but was swinging between gains and losses. The financial

and consumer services sectors were the only ones holding to higher

ground, while utility and consumer-goods stocks led decliners. On

Tuesday, the index rose 0.6%

(http://www.marketwatch.com/story/ftse-100-fights-for-firm-direction-as-inflation-hits-highest-in-almost-6-years-2017-12-12)

to mark its highest close since Nov. 8. and a third straight

win.

The pound bought $1.3348, up from $1.3317 in New York late

Tuesday.

In the fixed-income market, the 10-year gilt yield switched

direction and rose 2 basis points to 1.238%, according to Tradeweb.

Yields rise when prices fall.

What's moving markets: The pound hit an intraday high of $1.3369

after the Office for National Statistics said wage growth both

including and excluding bonuses rose in October, with basic

earnings growth of 2.5% above the 2.4% expected in a FactSet

consensus survey.

But wages are still lagging inflation. On Tuesday, the ONS said

annual consumer price inflation hit 3.1% in November

(http://www.marketwatch.com/story/uk-inflation-hits-almost-6-year-high-2017-12-12),

as rising airfares helped push the rate its highest level since

March 2012.

Read:U.K. wages fall again, in ongoing consumer squeeze

(http://www.marketwatch.com/story/uk-wages-fall-again-in-ongoing-consumer-squeeze-2017-12-13)

Central banks in focus: Traders will assess today's U.K. data in

the light of the Bank of England's minutes and monetary policy

decision, scheduled for release on Thursday.

See:What analysts are looking for in Thursday's Bank of England

meeting

(http://www.marketwatch.com/story/what-analysts-are-looking-for-in-thursdays-bank-of-england-meeting-2017-12-12)

BOE Gov. Mark Carney and his colleagues in November raised the

benchmark interest rate for the first time in a decade, by a

quarter percentage point, to 0.5%. Policy makers have signaled

rates could be raised by that same pace two more times over the

next three years.

Later Wednesday, the U.S. Federal Reserve will release its

monetary policy decision, with markets essentially pricing in an

announcement of a quarter-percentage-point interest-rate hike.

Outgoing Fed Chairwoman Janet Yellen will hold a press

conference at the conclusion of the bank's two-day meeting, and

investors will look for hints on the future pace of rate increases.

The decision is due at 7 p.m. London time, or 2 p.m. Eastern.

Yellen is scheduled to speak at 2:30 p.m. Eastern.

Stock movers: Dixons Carphone PLC (DC.LN) shares climbed 4.4% as

the electronics retailer said it logged record Black Friday sales

(http://www.marketwatch.com/story/dixons-carphone-tackling-mobiles-unit-performance-2017-12-13)

and that it's working on addressing issues at its mobile

division.

"We believe that we can, over time, reduce the complexity and

capital intensity of our mobile business model, and increase the

simplicity and profitability of what we do," said Chief Executive

Seb James.

TUI AG turned lower, losing 0.1%. The travel services company

early Wednesday said underlying earnings before interest, taxes and

amortization, or Ebita, grew 12% to EUR1.12 billion in fiscal 2017

(http://www.marketwatch.com/story/tuis-2017-profit-falls-extends-growth-guidance-2017-12-13).

Home builders were among decliners, with Barratt Developments

PLC (BDEV.LN) down 1.4% and Persimmon PLC (PSN.LN) off 1.7%.

(END) Dow Jones Newswires

December 13, 2017 06:05 ET (11:05 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

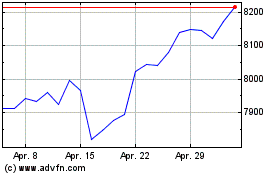

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024