LONDON MARKETS: FTSE 100 Veers Toward Second Straight Loss, With Miners Under Pressure

06 Dezember 2017 - 10:24AM

Dow Jones News

By Carla Mozee, MarketWatch

EasyJet upgraded

U.K. stocks dropped Wednesday, with mining shares leading

broad-based losses that could pull London's blue-chips market to a

second straight losing session.

What markets are doing: The FTSE 100 index fell 0.4% to

7,300.03, as the basic material, tech and industrial groups led all

sectors lower. On Tuesday, the index shed 0.2%

(http://www.marketwatch.com/story/ftse-100-lifted-by-rising-supermarket-stocks-weaker-pound-2017-12-05)

for its fourth loss in five sessions.

The pound bought $1.3438, little changed from $1.3442 late

Tuesday in New York. Against the euro, sterling bought EUR1.1339,

also little changed from Tuesday when the pound bought

EUR1.1367.

What's moving markets: Stocks trading in London and across

Europe followed in the footsteps of losses Tuesday on Wall Street

(http://www.marketwatch.com/story/dow-looks-on-track-for-another-record-while-nasdaq-appears-set-to-fall-again-2017-12-05),

where the S&P 500 Index fell for a third straight session,

suffering its longest losing streak since August. Weakness spilled

over to Asian markets. Overall in global markets, technology stocks

have been under pressure as investors had been rotating into banks

and retail shares as Washington hammers out plans to cut taxes.

Also, mining stocks have been knocked down in the wake of recent

losses for copper prices on worries over rising inventories and the

potential for slowing demand from China, which makes up about half

of global consumption for the industrial metal.

Stock movers: Copper prices were moving higher Wednesday

following Tuesday's slide of 4.7% on the Comex market, according to

FactSet data. Still, London-listed mining stocks were losing

ground. Glencore PLC (GLEN.LN) and Antofagasta PLC (ANTO.LN) each

fell 1.2%, Rio Tinto PLC (RIO) (RIO) (RIO) gave up 1.4% and BHP

Billiton PLC (BLT.LN) (BHP.AU) (BHP.AU) moved down 1.3%.

Hammerson PLC (HMSO.LN) fell 3.5%, at the bottom of the FTSE

100, after the retail property developer said Wednesday it's buying

shopping center owner Intu Properties (INTU.LN) for GBP3.4 billion

($4.6 billion). Intu shares rallied 18%.

EasyJet PLC (EZJ.LN) was up 1.4%, with a ratings upgrade to

overweight from underweight at J.P. Morgan Cazenove. The discount

airline said it'll roll out German domestic routes from Berlin next

month, according to media reports.

Off the FTSE 100, shares of Saga PLC (SAGA.LN) dropped 21% after

the travel and insurance company warned that it expects its

underlying profit growth

(http://www.marketwatch.com/story/saga-profit-lagging-on-monarch-collapse-headwinds-2017-12-06)

for its current financial year to be behind the previous year. It

cited more challenging insurance broking conditions and disruption

to its tour operations as reasons for the outlook.

(END) Dow Jones Newswires

December 06, 2017 04:09 ET (09:09 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

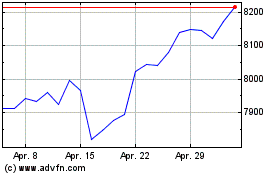

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024