Euro Drops After Eurozone Services PMI

05 Dezember 2017 - 6:54AM

RTTF2

The euro weakened against its major counterparts in the European

session on Tuesday, trimming early gains, after a data showed that

German services activity slowed more-than-estimated in November,

while Eurozone PMI matched preliminary reading. Final data from IHS

Markit showed that Eurozone private sector growth accelerated as

estimated in November.

The composite output index rose to 57.5 from 56.0 in October.

The score was unchanged from the earlier flash estimate.

The services Purchasing Managers' Index came in at 56.2, in line

with flash estimate, versus 55.0 in October.

Germany's composite output index improved to 57.3 from 56.6 in

October but below the flash reading of 57.6. At the same time, the

services PMI fell more-than-estimated to 54.3 from 54.7 a month

ago. The initial reading was 54.9.

Meanwhile, European stocks were trading mixed as investors

monitored currency movements and looked ahead to further progress

in Brexit talks and U.S. tax reform.

The currency has been trading in a positive territory in the

Asian session.

The euro dropped to 1.1842 against the greenback, from a high of

1.1877 hit at 9:30 pm ET. The euro is likely to locate support

around the 1.17 region.

The single currency retreated to 1.1673 against the franc, after

having advanced to a 4-day high of 1.1704 at 3:00 am ET. On the

downside, 1.15 is possibly seen as the next support for the euro.

The euro weakened to a 4-day low of 133.23 against the yen,

compared to 133.36 hit late New York Monday. Continuation of the

euro's downtrend may see it challenging support around the 132.00

mark.

The latest survey from Nikkei showed that Japan's services

sector continued to expand in November, albeit at a slower pace,

with a PMI score of 51.2.

That's down from the 26-month high of 53.4 in October, although

it remains well above the boom-or-bust line of 50 that separates

expansion from contraction.

The single currency slid to near 2-week lows of 1.5494 against

the aussie and 1.4995 against the loonie, from yesterday's closing

values of 1.5614 and 1.5035, respectively. Further downtrend may

take the euro to support levels of around 1.53 against the aussie

and 1.49 against the loonie.

On the flip side, the euro hit a 6-day high of 0.8868 against

the pound and held steady thereafter. The pair finished Monday's

trading at 0.8801.

Survey data from IHS Markit showed that British service sector

activity logged a further solid expansion in November, though the

rate of growth eased since October.

The IHS Markit/Chartered Institute of Procurement & Supply

Purchasing Managers' Index, dropped to 53.8 in November from 55.6

in October. Economists had expected the index to drop to 55.0.

Looking ahead, U.S. and Canadian trade data for October, ISM

non-manufacturing composite index and Markit's U.S services PMI for

November are slated for release in the New York session.

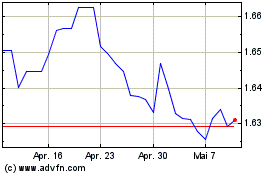

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Apr 2023 bis Apr 2024