Pound Advances Amid Brexit Optimism

29 November 2017 - 4:32AM

RTTF2

The pound strengthened against its major counterparts in

pre-European deals on Wednesday, following media reports that

Britain and the EU have edged closer towards a deal on Brexit

divorce bill, enabling to begin talks on an interim trade deal.

The U.K. has offered to pay more than €50 billion, although the

final amount will be dependent on how each side calculates the

figure from an "agreed methodology".

Settling the Brexit bill is a crucial condition for moving talks

on to future relations including a future free trade agreement.

Risk-on mood prevailed as investors shrugged off the latest

launch of a ballistic missile by North Korea and awaited key data

from the U.S., China and Japan due this week.

Current Fed Chair Janet Yellen will testify on the economic

outlook before the Congressional Joint Economic Committee later

today.

The full Senate could vote on the U.S. tax reform bill as early

as Thursday, although the legislation still includes significant

differences from the House version.

In economic front, data from the British Retail Consortium

showed that the U.K. shop prices fell 0.1 percent on year in

November.

That was in line with expectations and unchanged from the

October reading.

The pound advanced to near 3-week highs of 149.71 against the

yen and 0.8839 against the euro, from Tuesday's closing values of

148.66 and 0.8874, respectively. If the pound rises further, 151.00

and 0.86 are possibly seen as its next resistance levels against

the yen and the euro, respectively.

The U.K. currency firmed to a 2-month high of 1.3431 against the

greenback, up from Tuesday's closing value of 1.3337. Continuation

of the pound's uptrend may see it challenging resistance around the

1.36 area.

The pound that closed Tuesday's trading at 1.3119 against the

franc rose to near a 4-week high of 1.3212. The pound is seen

finding resistance around the 1.38 zone.

Looking ahead, Swiss Credit Suisse economic sentiment survey for

November, U.K. mortgage approvals for October, Eurozone economic

sentiment index and German preliminary CPI for November are due in

the European session.

In the New York session, U.S. pending home sales for October,

second estimate of GDP data for the third quarter and Fed Beige

book report are due.

At 9:00 am ET, the Bank of England governor Mark Carney speaks

about the Fair and Effective Markets Review at the Fixed Income

Currencies and Commodities Markets Standards Board, in London.

The BoE Deputy Governor David Ramsden participates in a panel

discussion at the Fixed Income Currencies and Commodities Markets

Standards Board in London at 9:45 am ET.

The Fed Chair Janet Yellen testifies on the US economic outlook

before Joint Economic Committee of Congress in Washington DC at

10:00 am ET.

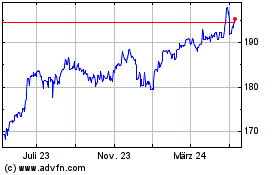

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

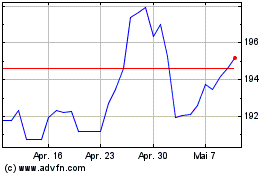

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Apr 2023 bis Apr 2024