- Q1 revenues of €349 million, down

9.3% reported and by 6.7% like-for-like

- Well-oriented Backlog, Fill Rate and

HD penetration metrics

- US Government renewals at c.95% in

value

- Al Yah 3 delay impacting Fixed

Broadband: FY 2017-18 revenues therefore adjusted -1 to - 2%

(versus ‘broadly stable’)

- All other objectives confirmed for

FY 2017-18 and coming years

Regulatory News:

Eutelsat Communications (Paris:ETL) (ISIN: FR0010221234 -

Euronext Paris: ETL) today reported revenues for the First Quarter

ended 30 September 2017.

Note: Since its First Half 206-17 results on 9 February 2017,

Eutelsat publishes revenues on the basis of five applications:

Video, Fixed Data and Government Services (Core Businesses), Fixed

Broadband and Mobile Connectivity (Connectivity).

Previous reported

applications

Proforma: New applications Variation In

€ millions

Q1 2016-17

In € millions

Q1 2016-171

Q1 2017-18 Vs. reported revenues

Like-for-like change2

Video Applications 224.3 Video Applications

226.5

223.3 N/A -0.8% Data Services

56.8 Fixed Data 43.4

37.1 -11.7%

Value-Added Services 29.4 Government Services

42.3

41.1 +1.1% Government Services 47.1

Fixed Broadband 24.9

22.3 -9.7% Other

revenues 27.1 Mobile Connectivity 14.5

18.6 +33.3%

Other revenues3

27.1

6.8 -74.8%

Total

384.8 Total 378.7

349.1 -9.3% -6.7% EUR/USD

exchange rate 1.11

1.16

Rodolphe Belmer, Chief Executive Officer, commented: “First

Quarter revenues were in line with our expectations. Our key

operational metrics were well oriented with a further rise in HD

penetration, a stabilisation of the Backlog and an improved Fill

Rate on a quarter-on-quarter basis. The Fall renewal campaign with

the US Government yielded a favourable outturn, at some 95% in

value while the outcomes of Video renewals during the quarter were

positive, notably with Polsat on HOTBIRD. Elsewhere we took further

measures to optimise Video distribution with the absorption of

Noorsat in the MENA region.

“For the remainder of the year, revenues in our Core Businesses

are on track, and Mobility will further benefit from the entry into

service of EUTELSAT 172B in November. However, the late

availability of the payload leased on the Al Yah 3 satellite,

representing the majority of the capacity dedicated to Konnect

Africa, will push out revenues in Fixed Broadband. In recognition

of this delay, revenue expectations for FY 2017-18 are mechanically

adjusted from ‘broadly stable’ to between -1 and -2%. This

adjustment will not affect our ability to attain our other

objectives, in particular EBITDA margin and discretionary free

cashflow, which are all re-affirmed for the current and future

years.”

1 Proforma revenues reflecting disposals of Wins/DHI and DSAT

Cinema. For more details, please refer to the appendices.2 At

constant currency and perimeter.3 Other revenues include mainly

compensation paid on the settlement of business-related litigation,

the impact of EUR/USD currency hedging, the provision of various

services or consulting/engineering fees as well as termination

fees.

KEY EVENTS

The key events of the First Quarter were as follows:

- Q1 revenues down 1.0% at constant

currency and perimeter and excluding ‘Other’ revenues;

- Well-oriented operational metrics, with

a further rise in HD penetration as well as a stabilisation of the

Backlog and an improved Fill Rate on a quarter-on-quarter

basis;

- Favourable outcome of the US Government

Fall renewals with a rate of almost 95% in value;

- Positive outcome of Video contract

renewals, notably with Cyfrowy Polsat on HOTBIRD;

- Absorption of Noorsat to optimise Video

distribution in the MENA region;

- Delayed availability of Al Yah 3

capacity impacting Konnect Africa ramp-up. All other verticals on

track.

FIRST QUARTER REVENUES4

First Quarter revenues stood at €349.1 million, down 6.7%

at constant currency and perimeter. On a reported basis, revenues

were down 9.3% reflecting a €6 million negative perimeter effect

(disposal5 of Wins/DHI and DSAT Cinema) and a €5 million negative

currency effect.

Excluding ‘Other’ revenues, the underlying applications were

down 1.0% like-for-like.

Quarter-on-quarter, revenues were down 2.6% on a reported basis

and by -0.2% on a like-for-like basis.

Unless otherwise stated, all variations indicated below are on a

like-for-like basis.

Core businesses

Video Applications (65% of revenues)

First Quarter revenues for Video Applications amounted to

€223.3 million, down 0.8% year-on-year. Revenues from Broadcast

were up 0.5% year-on-year excluding the carry-forward impact of the

termination of the TV d’Orange contract last year, with growth

coming from Russia (at the 36° East and 56° East orbital positions)

and MENA (at the 7/8° West and 7° East orbital positions).

Professional Video revenues continued to reflect ongoing tough

conditions.

Revenues were up by 0.7% quarter-on-quarter.

At 30 September 2017, the total number of channels broadcast by

Eutelsat satellites stood at 6,755, up 6.6% year-on-year. The

number of HD channels stood at 1,210 versus 940 a year earlier, up

by 28.7% and represented 17.9% of channels compared to 14.8% a year

earlier.

On the commercial front a major contract was renewed with

Cyfrowy Polsat at the HOTBIRD position as well as with the

distributor, Globecast. Elsewhere, the Group took steps to

streamline Video distribution in MENA with the absorption of

Noorsat, its largest reseller in the region.

Fixed Data (11% of revenues)

First Quarter revenues for Fixed Data stood at €37.1

million, down 11.7% year-on-year. They continued to reflect ongoing

pricing pressure in all geographies.

Quarter-on-quarter revenues were down by 4.7%.

Government Services (12% of revenues)

In the First Quarter, Government Services revenues stood

at €41.1 million, up 1.1% year-on-year, reflecting the carry-over

effect of the solid commercial performance in FY 2016-17.

Revenues were down by 2.0% quarter-on-quarter, reflecting the

absence of the positive one-off recorded in the fourth quarter of

2016-17.

The latest round of contract renewals with the US Government

(Fall 2017) resulted in an estimated renewal rate of almost 95% in

value, with virtually stable volumes and a slight decline in

price.

4 The share of each application as a percentage of total

revenues is calculated excluding “other revenues”. Unless otherwise

stated, all growth indicators are made in comparison with First

Quarter ended 30 September 2016.5 Wins/DHI (Mobile Connectivity)

deconsolidated from end-August 2016 and DSAT Cinema (Video) from

end-October 2016.

Connectivity

Fixed Broadband (7% of revenues)

Fixed Broadband revenues stood at €22.3 million, down

9.7% year-on-year, reflecting the absence of a positive one-off

booked last year related to the phasing of payments by a specific

customer. Underlying trends in European Broadband remained

resilient, with a decline in subscriber numbers broadly offset by a

well-oriented ARPU.

Quarter-on-quarter, revenues were down by 3.5%.

The launch and entry into service of Yahsat’s Al Yah 3

satellite, on which Eutelsat will lease the majority of the

capacity dedicated to Konnect Africa, is now definitively delayed,

with the start of commercial services on this satellite now

expected in June 2018 at the earliest. The attendant postponement

of related commercial initiatives, is also affecting revenue

generation on the Al Yah 2 satellite. In consequence, the vast

majority of revenue expectations from Konnect Africa are pushed out

into FY 2018-19.

Mobile Connectivity (5% of revenues)

Mobile Connectivity revenues stood at €18.6 million, up

33.3% year-on-year, reflecting the effect of the Taqnia contract

signed last year as well as continued growth on wide-beam capacity

with customers including Gogo, Hunter and Panasonic.

Revenues were up by 5.1% quarter-on-quarter.

Revenues will benefit from the entry into service of EUTELSAT

172B in November, on which the incremental HTS payload for

in-flight connectivity is partly pre-sold.

Other Revenues

Other revenues amounted to €6.8 million in the First

Quarter versus €27.1 million a year earlier and €6.0 million in the

Fourth Quarter last year.

In Q1 2016-17, they included fees in respect of technical and

engineering services provided to a third party operator,

termination fees related to the rationalisation of the distribution

at HOTBIRD as well as revenues related to the agreements with SES

at 28.5° East, which ended on 31 December 2016.

OPERATIONAL AND UTILISED

TRANSPONDERS

The number of operational 36 MHz-equivalent transponders stood

at 1,374 at 30 September 2017, up by 47 units compared with

end-September 2016, reflecting principally the entry into service

of EUTELSAT 117 West B in January 2017. As a result, the fill rate

stood at 68.4% at end-September 2017 versus 71.5% a year earlier,

reflecting mainly the impact of this new capacity.

An incremental nine transponders have been sold since end-June

2017.

30

September

2016

30 June

2017

30 September

2017

Number of operational 36 MHz-equivalent

transponders 6

1,327 1,372

1,374

Number of utilised 36 MHz-equivalent

transponders7

948 931

940 Fill rate 71.5% 67.9%

68.4%

Note: Based on 36 MHz-equivalent transponders excluding

high throughput capacity (KA-SAT 82 spotbeams, EUTELSAT 3B 5

Ka-band spotbeams, EUTELSAT 65 West A 24 Ka-band spotbeams,

EUTELSAT 36C 18 Ka-band spotbeams and 16 spotbeams leased on Al Yah

2 satellite).

6 Number of 36 MHz-equivalent transponders on satellites in

stable orbit, back-up capacity excluded.7 Number of 36

MHz-equivalent transponders utilised on satellites in stable

orbit.

BACKLOG

The backlog8 stood at €5.2 billion at 30 September 2017, versus

€5.4 billion at end September 2016, and €5.2 billion at end-June

2017. The sequential stabilization in the Backlog reflects video

renewals during the quarter which offset natural consumption.

The backlog was equivalent to 3.5 times 2016-17 revenues, with

Video representing 86%.

30

September

2016

30 June

2017

30 September 2017 Value of contracts (in billions of

euros) 5.4 5.2

5.2 In years of annual

revenues based on last fiscal year 3.6 3.5

3.5 Share of

Video Applications 85% 85%

86%

OUTLOOK

Based on the performance of the First Quarter, revenues from the

Core businesses and Mobile Connectivity are on track to meet full

year targets. On the other hand, Fixed Broadband revenues will be

below expectations mainly due to the delayed availability of the Al

Yah 3 satellite.

In consequence, total revenues for FY 2017-18 are now expected

at between -1 and -2% (at constant currency and perimeter9), versus

‘broadly stable’ previously.

This adjustment has no impact on the other elements of the

financial outlook which are all confirmed for the current and

coming years:

- Revenues (at constant currency

and perimeter) are expected to return to slight growth from FY

2018-19;

- The EBITDA margin (at constant

currency) is expected above 76% for FY 2017-18. From FY 2018-19

onwards it is expected at above 77%;

- Cash Capex will be maintained at

an average of €420 million10 per annum for the period July 2017 to

June 2020;

- Discretionary Free Cash Flow11

is expected to deliver mid-single digit CAGR in the period July

201712 to June 2020 (at constant currency), with growth back-end

loaded in the outer two years;

- The Group is committed to maintaining a

sound financial structure to support its investment grade credit

rating and aims at a net debt / EBITDA ratio below

3.0x;

- It also retains its commitment to

serving a stable to progressive dividend.

This outlook is based on the nominal deployment plan

hereunder.

FLEET DEVELOPMENTS

Nominal launch programme

The upcoming launch schedule is indicated below.

8 The backlog represents future revenues from capacity lease

agreements and can include contracts for satellites under

procurement.9 For fiscal year 2016-17, revenues on the basis of

perimeter as of 30 June 2017 stood at €1,472 million (excluding

revenues from Wins/DHI and DSAT Cinema which were sold during

fiscal year 2016-17)10 Including capital expenditure and payments

under existing export credit facilities and long-term lease

agreements on third party capacity.11 Net cash-flow from operating

activities – Cash Capex - Interest and Other fees paid net of

interest received12 Discretionary Free-Cash-Flow of €407.8 million

in FY 2016-17.

Satellite1

Orbital

position

Estimated launch(calendar year)

Main

applications

Main geographic coverage Physical

transponders

36 MHz-equivalent transponders / Spotbeams

Of which expansion

36 MHz-equivalent transponders

EUTELSAT 7C 7° East H2 2018 Video

Turkey, Middle-East, Africa 44 Ku 49 Ku 19 Ku

EUTELSAT 5 WEST B 5° West H2 2018 Video

Europe, MENA 35 Ku 35 Ku None EUTELSAT QUANTUM

To be

confirmed

2019 Government Services Flexible 8

beams“QUANTUM” Not applicable Not applicable African

Broadband satellite To be

confirmed

2019 Broadband Africa 65 spotbeams

75 Gbps 75 Gbps

1 Chemical propulsion satellites (EUTELSAT

QUANTUM, EUTELSAT 5 West B) generally enter into service 1 to 2

months after launch. Electric propulsion satellites (EUTELSAT 7C

and the African Broadband satellite) between 4 and 6 months.

The launch of the Al Yah 3 satellite, on which Eutelsat will

lease capacity for its Konnect Africa project, is now expected in

the first quarter of 2018.

Changes in the fleet

There have been no changes in the fleet since 30 June 2017.

GOVERNANCE

The Board of 27 July 2017 proposed, amongst others, the

following resolutions to be submitted to the vote of shareholders

present at the Annual General Meeting of 8 November 2017:

- Approval of the accounts;

- Dividend relating to Financial Year

2016-2017;

- Appointment of Dominique D’Hinnin

(currently permanent representative of FSP) as a Board Member.

Following the AGM and subject to the approval of this appointment,

Dominique D’Hinnin will replace Michel de Rosen who will step down

from his functions as Chairman and Board Member of Eutelsat

Communications; Agnès Audier will replace Dominique D’Hinnin as

permanent representative of FSP.

- Appointment of Esther Gaide,

Paul-François Fournier and Didier Leroy as Board Members;

- Compensation of corporate officers and

compensation policy;

- Several financial resolutions.

Subject to the approval of the Annual General Meeting, the Board

of Directors will comprise 12 members of which eight independent

(Dominique D’Hinnin, FSP (which will be represented by Agnès

Audier), Esther Gaide, Didier Leroy, Lord Birt, Ana Garcia Fau,

Ross Mc Innes, Carole Piwnica).

RECENT EVENTS

Acquisition of Noorsat

Eutelsat acquired 100% of NOORSAT, one of the leading satellite

service providers in the Middle East, from Bahrain’s Orbit Holding

Group for a consideration of US$75 million, debt- and cash-free.

The acquisition will add upwards of US$15 million to Eutelsat’s

consolidated revenues on an annualised basis after the elimination

of the capacity leased by NOORSAT from Eutelsat. Its slightly

dilutive impact on Eutelsat’s EBITDA margin will be absorbed within

existing margin objectives.

******

First Quarter 2016-17 revenues conference call

A conference call will be held on Thursday, 26 October

2017 at 18.30 CET / 17.30 GMT / 12:30 EST

To connect to the call, please use the following numbers:

- France: +33 (0) 1 76 77 22 74

- UK: +44 (0) 330 336 9105

- United States: +1 719 325

2202Access code: 8203389#

Instant replay will be available from 26 October, 22.00 CET to 2

November, 22.00 CET on the following numbers:

- France: +33 (0) 1 70 48 00 94

- UK: + 44 (0) 207 984 7568

- United States: + 1 719 457

0820Access code: 8203389 #

Financial calendar

Note: The financial calendar is provided for information

purposes only. It is subject to change and will be regularly

updated.

- 8 November 2017: Annual General

Shareholders’ Meeting

- 16 February 2018: First Half 2017-18

results

APPENDICES

Quarterly revenues by application

Proforma revenues

As a reminder,

- Proforma revenues were published with

the H1 2016-17 revenues release on 9 February 2017, reflecting

notably new classification of revenues on the basis of five

applications: Video, Fixed Data and Government Services (Core

Businesses), and Fixed Broadband and Mobile Connectivity

(Connectivity).

- Wins / DHI (Mobile Connectivity) was

deconsolidated from end-August 2016 and DSAT Cinema (Video) from

end-October 2016.

The table below shows quarterly proforma revenues for FY 2016-17

under the new classifications and excluding revenues from Wins /

DHI and DSAT Cinema:

In € millions

Q1 2016-17

Q2 2016-17 Q3 2016-17 Q4

2016-17 FY 2016-17 Q1 2017-18 Video

226.5 228.7 228.1 224.3 907.7

223.3 Fixed Data 43.4 41.4 42.1

41.1 168.1 37.1 Government Services 42.3

43.8 45.2 44.8 176.1 41.1 Fixed

Broadband 24.9 23.7 24.2 23.4

96.2 22.3 Mobile Connectivity 14.5 17.9

17.2 18.9 68.5 18.6 Other revenues 27.1

14.5 7.5 6.0 55.0 6.8

Total 378.7 370.0

364.3 358.5 1,471.6

349.1

Reported Revenues for FY 2016-17

Under the previous classification (Q1 only):

In € millions

Q1 2016-17 Video

Applications 224.3 Data Services 56.8 Value-Added

Services 29.4 Government Services 47.1 Other revenues

27.1

Total 384.8

Under the new classifications:

In € millions

Q1 2016-17 Q2

2016-17 Q3 2016-17 Q4 2016-17

FY 2016-17 Video 226.5 228.9

228.1 224.3 908.0 Fixed Data 43.4 41.4

42.1 41.1 168.1 Government Services

42.3 43.8 45.2 44.8 176.1 Fixed

Broadband 24.9 23.7 24.2 23.4

96.2 Mobile Connectivity 20.6 17.9 17.2

18.9 74.6 Other revenues 27.1 14.5 7.5

6.0 55.0

Total 384.8

370.2 364.3 358.5

1,477.9

About Eutelsat Communications:

Founded in 1977, Eutelsat Communications

is one of the world's leading satellite operators. With a global

fleet of satellites and associated ground infrastructure, Eutelsat

enables clients across Video, Data, Government, Fixed and Mobile

Broadband markets to communicate effectively to their customers,

irrespective of their location. Over 6,600 television channels

operated by leading media groups are broadcast by Eutelsat to one

billion viewers equipped for DTH reception or connected to

terrestrial networks. Headquartered in Paris, with offices and

teleports around the globe, Eutelsat assembles 1,000 men and women

from 32 countries who are dedicated to delivering the highest

quality of service. Eutelsat Communications is listed on the

Euronext Paris Stock Exchange (ticker: ETL). For more about

Eutelsat go to www.eutelsat.com

Disclaimer

The forward-looking statements included herein are for

illustrative purposes only and are based on management’s current

views and assumptions. Such forward-looking statements involve

known and unknown risks. For illustrative purposes only, such risks

include but are not limited to: postponement of any ground or

in-orbit investments and launches including but not limited to

delays of future launches of satellites; impact of financial crisis

on customers and suppliers; trends in Fixed Satellite Services

markets; development of Digital Terrestrial Television and High

Definition television; development of satellite broadband services;

Eutelsat Communications’ ability to meet market demand; the effects

of competing technologies developed and expected intense

competition generally in its main markets; profitability of its

expansion strategy; partial or total loss of a satellite at launch

or in-orbit; supply conditions of satellites and launch systems;

satellite or third-party launch failures affecting launch schedules

of future satellites; litigation; ability to establish and maintain

strategic relationships in its major businesses; and the effect of

future acquisitions and investments.

Eutelsat Communications expressly disclaims any obligation or

undertaking to update or revise any projections, forecasts or

estimates contained in this presentation to reflect any change in

events, conditions, assumptions or circumstances on which any such

statements are based, unless so required by applicable law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171026006105/en/

Eutelsat CommunicationsPress

RelationsVanessa O’Connor, + 33 1 53 98 37

91voconnor@eutelsat.comorMarie-Sophie Ecuer, + 33 1 53 98 37

91mecuer@eutelsat.comorInvestor

RelationsJoanna Darlington, + 33 1 53 98 31

07jdarlington@eutelsat.comorCédric Pugni, + 33 1 53 98 31

54cpugni@eutelsat.com

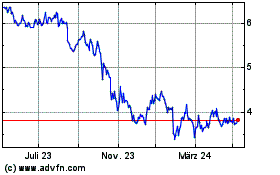

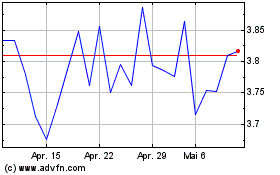

Eutelsat Communications (EU:ETL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Eutelsat Communications (EU:ETL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024