EUROPE MARKETS: European Stocks Nudge Higher As Volvo Rallies

20 Oktober 2017 - 12:18PM

Dow Jones News

By Carla Mozee, MarketWatch

Spanish shares continue to slip on Catalonia tensions, helping

push Stoxx 600 to weekly loss

European stocks edged higher Friday, but Spanish stocks were

held back as worries persisted about the Spain-Catalonia standoff

over independence for the wealthy region.

Meanwhile, shares of Swedish truck maker Volvo AB leapt by the

most in six months after a bullish earnings report.

How indexes are moving: The Stoxx Europe 600 index picked up

0.2% at 389.81, led by financial and industrial shares. But the

consumer goods and health care groups were losing ground. On

Thursday, the pan-European index fell 0.6%

(http://www.marketwatch.com/story/european-stocks-hit-by-cocktail-of-worries-over-catalonia-china-2017-10-19)

to mark its lowest close in nearly three weeks.

For the week, the regional benchmark was on track to drop 0.5%,

which would be the first weekly loss in six.

In Madrid, the IBEX 35 on Friday drifted down 0.1% to 10,192.40,

as Catalan separatists vowed to protest the expected withdrawal of

autonomy from the region.

Germany's DAX 30 index moved up 0.2% to 13,017.70, and France's

CAC 40 clung to a 0.1% rise to reach 5,372.58.

In London, the FTSE 100 gained 0.1% to hit 7,533.65, paring a

bigger advance at the open

(http://www.marketwatch.com/story/ftse-100-gains-as-us-budget-vote-pushes-pound-lower-2017-10-20).

Volvo revs up: Topping the Stoxx Europe 600 index was Volvo

(VOLV-B.SK) , as its stock rallied as much as 7.6%. That was the

biggest jump in price since April, according to FactSet data. The

move came after the Swedish truck maker reported a surge in

third-quarter net profit, easily beating analyst estimates

(http://www.marketwatch.com/story/volvo-profit-beats-views-as-truck-orders-surge-2017-10-20)

, as truck and construction-equipment orders climbed.

What's driving markets: The firm open for European stocks was

driven in part by a decline in the euro against the U.S. dollar, as

a weaker euro can make European products less expensive for

overseas customers to purchase.

The dollar rose after the U.S. Senate late Thursday narrowly

approved a Republican budget resolution

(http://www.marketwatch.com/story/senate-republicans-approve-budget-proposal-clearing-path-to-tax-overhaul-2017-10-19).

The 51-49 vote paves the way for tax reforms backed by U.S.

President Donald Trump that could lead to $1.5 trillion in U.S. tax

cuts, analysts said.

The swing to a weekly decline in European stocks was driven in

part by Spanish shares, which have struggled as tensions over

Catalonia's bid for independence persist.

The Spanish central government on Saturday is slated to hold an

extraordinary meeting to invoke Article 155 of the country's

constitution. That would trigger the process to strip Catalonia of

some of its home-rule powers

(http://www.marketwatch.com/story/standoff-in-spain-intensifies-as-government-gears-up-to-strip-autonomy-from-catalonia-2017-10-19),

after Catalan leaders failed to meet a demand to give up their push

for secession.

What strategists are saying: "The Trump trade has been

reignited, so it seems. Tax reform is definitely back on -- if it

was ever off, thanks to the Senate approving of the

Republican-backed budget Thursday night," said Neil Wilson, senior

market analyst at ETX Capital, in a note.

Stock movers: Shares of Ericsson AB (ERIC) climbed 3.3%, even as

the Swedish wireless-communications gear supplier's third-quarter

net loss widened sharply.

(http://www.marketwatch.com/story/ericsson-losses-widen-sharply-amid-shake-up-2017-10-20)

Accor SA (AC.FR) shares fell 2.2% after the French hotelier's

third-quarter financial report.

ArcelorMittal (MT) was up 1.8% after a ratings upgrade to buy

from neutral at UBS.

Brexit in focus: Donald Tusk, president of the European Council,

said European Union leaders have given the go-ahead to start

internal discussions on the second phase of Brexit talks. However,

that does not mean those talks on trade are ready to start,

observers said.

(https://twitter.com/eucopresident/status/921308246127857664)

Late Thursday, U.K. Prime Minister Theresa May appealed to other

leaders for a shift in Brexit talks, but appeared to be yield

little response. The EU summit in Brussels ends Friday.

(END) Dow Jones Newswires

October 20, 2017 06:03 ET (10:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

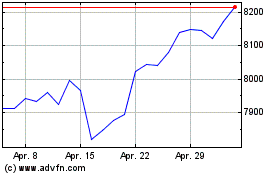

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024