Global Stocks Touch New Highs

13 Oktober 2017 - 4:12PM

Dow Jones News

By Riva Gold and Lucy Craymer

-- World stocks on track for fresh record

-- Pound continues to strengthen

-- Nikkei above 21000

Stocks found fresh momentum Friday, with a popular gauge of

global equities on track to end at its highest on record.

The MSCI World equity benchmark of large and mid-cap stocks was

set to hit another all-time high amid gains in Asian and European

bourses.

The Dow Jones Industrial Average gained 36 points, or 0.2%, to

22877 shortly after the opening bell. The S&P 500 added 0.1%,

and the Nasdaq Composite climbed 0.2%.

The Stoxx Europe 600 edged up 0.1%, following gains in Japan and

Australia.

Europe's banking sector pared some early losses after declines

in bank shares pulled U.S. stocks away from record levels

Thursday.

Shares of Bank of America fell 0.8% after the bank reported its

quarterly profit had risen 13% from a year earlier. Wells Fargo

slid 4% as the bank reported weaker-than-expected third-quarter

revenue, down 2% from a year ago

Recent economic data releases have helped confirm a synchronized

pickup in global growth, just as the third-quarter earnings season

has so far pointed to a healthy corporate sector, encouraging

equity investors. Flows into global equity funds during the week

ending Oct. 11 hit a record, according to fund tracker EPFR

Global.

"I continue to see a positive story for risk," said Tina Byles

Williams, chief investment officer at FIS Group.

"All the normal signs of economic activity and earnings are in a

positive direction with the possible exception of China," she

added, saying she favors stocks in Japan and Europe.

Gains in commodity prices supported shares of energy and mining

companies on Friday. Brent crude oil gained 2.1% to $57.42 a

barrel.

Germany's DAX index was flat near all-time highs. Shares of

Bayer rose 1.1% after the German company agreed to sell parts of

its crop-science business to rival BASF, whose shares fell

0.2%.

London's export-heavy FTSE 100 fell 0.2% from a record close,

bucking the global trend of gains, as the pound continued its

ascent against the dollar.

The pound was last up 0.4% at $1.3315 following media reports

that Michel Barnier, the European Union's chief Brexit negotiator,

said Thursday that the EU might agree to a two-year transition

period. Sterling had fallen sharply earlier Thursday on reports of

deadlocked negotiations.

In Asian trading Friday, stocks closed mostly up. Korea's Kospi,

however, struggled to log a third-straight record close, edging

down less than 0.1%.

Traders came back from the midday break in Japan in an upbeat

mood, with the Nikkei climbing more after sprinting to heights last

seen in 1996. The benchmark finished up 1% at 21211.29.

"The Nikkei has got a lot of tailwinds behind it and few of the

headwinds of other markets," said Rob Carnell, ING's Asia-Pacific

research chief.

Despite looming elections, he noted markets weren't concerned

there will be a change of government in Japan, while export figures

continue to be strong and the Bank of Japan remains in expansionary

mode.

New Zealand's stock benchmark logged a record-extending

ninth-straight gain to new highs and Australian shares rose

0.3%.

Amid Friday's stock gains, China released figures showing

imports jumped a bigger-than-expected 19% in dollar terms from a

year earlier in September. The Shanghai Composite rose 0.1%.

Yields on 10-year Treasury notes edged down to 2.279% from

2.323%. German bund yields edged down to 0.404% from 0.445%. Yields

move inversely to prices.

That followed media reports suggesting the European Central Bank

might keep its bond purchases going for longer, even as it reduces

the size of the program by more than expected.

"Overall, the developments suggest that the ECB will continue to

stress that loose policy will remain in place for a long time even

as they begin to slow the pace of quantitative easing," said

strategists at MUFG.

Marina Force contributed to this article.

Write to Riva Gold at riva.gold@wsj.com and Lucy Craymer at

Lucy.Craymer@wsj.com

(END) Dow Jones Newswires

October 13, 2017 09:57 ET (13:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

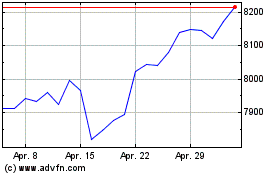

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024