Dollar Extends Rally As U.S. Jobs Data Boosts Rate Hike Bets

06 Oktober 2017 - 12:14PM

RTTF2

The U.S. dollar continued to be higher against its key

counterparts in the European session on Friday, as an unexpected

decline in the nation's jobless rate along with an acceleration in

wage growth in September strengthened support for another Fed rate

in December.

Data from the Labor Department showed that the unemployment rate

dipped to 4.2 percent in September from 4.4 percent in August.

Economists had expected the unemployment rate to hold at 4.4

percent.

Wage growth picked up, with the average hourly employee earnings

rising 2.9 percent on year in September from 2.5 percent in

August.

Nonetheless, the employment fell unexpectedly due to the impact

of Hurricanes Harvey and Irma.

The non-farm payroll employment fell by 33,000 jobs in September

after climbing by upwardly revised 169,000 jobs in August. The

economists had expected employment to rise by 90,000 jobs.

Federal Reserve Governors William Dudley, Robert Kaplan, and

James Bullard will deliver speeches at separate events, which will

be closely monitored for policy outlook.

The currency has been trading higher in the Asian session on

optimism over progress in U.S. tax reform plan. Further, Thursday's

data on jobless claims, factory orders and trade balance showed

indications of solid economic growth.

The greenback added 0.5 percent to hit 0.9829 against the franc,

a level unseen since May 17. The pair was valued at 0.9783 when it

closed deals on Thursday. If the greenback extends rise, 0.99 is

possibly seen as its next resistance level.

The greenback appreciated to near a 3-month high of 113.32

against the yen, compared to 112.80 hit late New York Thursday. The

greenback is poised to challenge resistance around the 114.00

region.

Preliminary data from the Cabinet Office showed that Japan's

leading index improved to the highest level seen since early 2014

in August.

The leading index, which measures the future economic activity,

rose to 106.8 in August from 105.2 in the previous month.

The greenback climbed to near a 2-month high of 1.1670 against

the euro, after having dropped to 1.1716 at 9:30 pm ET. On the

upside, the greenback may target 1.15 as the next resistance

level.

Data from Destatis showed that Germany's factory orders

rebounded at a faster-than-expected pace in August.

Factory orders grew 3.6 percent month-on-month in August,

reversing a revised 0.4 percent fall in July. Orders were forecast

to climb 0.7 percent.

The greenback strengthened to a new 4-week high of 1.3036

against the pound, a 0.6 percent rise from Thursday's closing value

of 1.3119. Continuation of the greenback's uptrend may see it

challenging resistance around the 1.29 mark.

Data from the mortgage lender Halifax and IHS Markit showed that

UK house prices increased at a faster pace in September.

House prices increased 4 percent year-on-year in three months to

September, faster than the 2.6 percent rise seen in three months to

August. This was the biggest annual growth since February and

exceeded the expected rate of 3.6 percent.

The greenback firmed to near a 3-month high of 0.7742 against

the aussie and more than a 4-month high of 0.7059 against the kiwi,

from its prior lows of 0.7798 and 0.7118, respectively. The

greenback is seen finding resistance around 0.76 against the aussie

and 0.69 against the kiwi.

Although the greenback hit a new 5-week high of 1.2597 against

the loonie in the aftermath of the data, it retreated to 1.2541

immediately. The pair was worth 1.2565 at yesterday's close.

Looking ahead, U.S. wholesale sales and consumer credit for

August as well as Canada Ivey PMI for September are set for release

shortly.

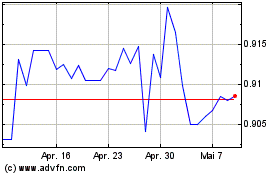

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Apr 2023 bis Apr 2024