Euro Climbs Amid Risk Appetite As Catalonia Worries Ease

03 Oktober 2017 - 9:14AM

RTTF2

The euro advanced against its key counterparts in European deals

on Tuesday amid risk appetite, as a sell-off in Spanish markets

eased after Spanish Prime Minister Mariano Rajoy attempted to

resolve the issue of Catalan independence.

Rajoy on Monday said the government will seek a joint response

with other political parties to the "pro-independence challenge" in

Catalonia.

The European Commision dismissed Catalonia's disputed

referendum, saying it as "not legal" under the Spanish Constitution

and urged dialogue between Barcelona and Madrid to solve the

crisis.

The European parliament will hold a special debate on Wednesday

on the issue.

Data from Eurostat showed that Eurozone producer prices grew the

most in three months in August.

Producer prices increased 2.5 percent year-on-year in August,

faster than the 2 percent rise seen in July. The annual rate

exceeded the expected 2.3 percent and was the fastest since June

2017.

Excluding energy, producer price inflation rose marginally to

2.2 percent from 2.1 percent a month ago.

The currency showed mixed trading in the Asian session. While it

rose against the yen and the franc, it held steady against the

pound. Against the greenback, it fell.

The euro climbed to 1.1751 against the greenback, from an early

1-1/2-month low of 1.1696.The euro is likely to find resistance

around the 1.19 region.

The euro advanced to a 4-day high of 1.1464 against the franc,

off its early low of 1.1428. The next possible resistance for the

euro-franc pair is seen around the 1.19 area.

The single currency reversed from an early 6-day low of 132.17

against the Japanese yen, bouncing off to 132.86.The euro is seen

finding resistance around the 135.00 level.

Survey data from the Cabinet Office showed that Japan's consumer

confidence improved more-than-expected in September.

The consumer sentiment index rose to 43.9 from 43.3 in August.

The expected reading was 43.5. A similar high score was last seen

in March.

The euro edged up to 0.8867 against the pound, after having

fallen to 0.8822 at 3:00 am ET. If the euro-pound pair extends

rise, 0.90 is possibly seen as its next resistance level.

Data from IHS Markit showed that the UK construction sector

contracted in September on weak new work.

The IHS Markit/Chartered Institute of Procurement & Supply

construction Purchasing Managers' Index fell to 48.1 in September

from 51.1 in August. The reading was expected to remain unchanged

at 51.1.

The euro rose to 1.5047 against the aussie and 1.4716 against

the loonie, from its early 5-day low of 1.4971 and a 4-day low of

1.4661, respectively. On the upside, 1.53 and 1.48 are likely seen

as the next resistance levels for the euro against the aussie and

the loonie, respectively.

The single currency spiked up to a weekly high of 1.6398 against

the kiwi, from a low of 1.6292 hit at 10:15 pm ET. The euro is

poised to challenge resistance around the 1.65 mark.

Looking ahead, at 8:30 am ET, Federal Reserve Governor Jerome

Powell speaks about regulatory reform at a financial regulation

event jointly hosted by Reuters and George Washington University in

Washington DC.

At 12:30 pm ET, the Bank of Canada Deputy Governor Sylvain Leduc

speaks about Canadian business creation and productivity at the

Sherbrooke Chamber of Commerce, in Quebec.

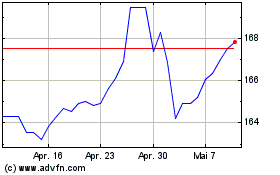

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

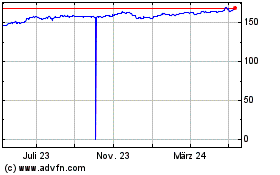

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024