Pound Slides After U.K. GDP Data

29 September 2017 - 9:15AM

RTTF2

The British pound weakened against other major currencies in the

Asian session on Friday, after data showed that the U.K. economic

growth expanded at a slower pace year-on-year in the second

quarter, than previously estimated.

Data from the Office for National Statistics showed that

Britain's economy grew 1.5 per cent in the three months ending in

June from the same period in 2016. It was the weakest level since

the first quarter of 2013. Economists had forecast the GDP to

remain unchanged from a previous estimate at 1.7 percent.

The U.K. economy grew as previously estimated in the second

quarter. Nonetheless, past data on the national accounts and

balance of payments were revised.

Gross domestic product grew 0.3 percent sequentially in the

second quarter, unrevised from the second estimate published on

August 24, and the same rate as seen in the first quarter.

The first quarter growth was revised up from 0.2 percent.

In an another report, ONS said the current account deficit

widened to GBP 23.2 billion from GBP 22.3 billion in the first

quarter.

Also, data from the Bank of England showed that U.K. mortgage

approvals declined in August. The number of mortgage approvals fell

more-than-expected to 66,580 in August from 68,452 in the previous

month. The expected level was 67,300.

In other economic news, data from the Nationwide Building

Society showed that U.K. house prices increased at a slower pace in

September. London became the weakest performing region for first

time since 2005, with house prices down 0.6 percent

year-on-year.

On a national level, house prices grew 2 percent in September

from the previous year, following August's 2.1 percent increase.

Economists had forecast a marginal 0.1 percent increase.

On a monthly basis, house prices gained 0.2 percent, in contrast

to a 0.1 percent fall in August.

In the Asian trading today, the pound held steady against its

major rivals.

In the European trading, the pound fell to a 3-day low of 150.20

against the yen, from an early high of 151.28. The pound may test

support near the 147.00 region.

Against the euro and the Swiss franc, the pound dropped to 4-day

lows of 0.8836 and 1.2968 from early highs of 0.8763 and 1.3042,

respectively. If the pound extends its downtrend, it is likely to

find support around 0.89 against the euro and 1.27 against the

franc.

The pound edged down to 1.3354 against the U.S. dollar, from an

early high of 1.3443. On the downside, 1.31 is seen as the next

support level for the pound.

Looking ahead, Canada GDP data for July and industrial product

price index for August, as well as U.S. personal income and

spending data for August and University of Michigan's final

consumer sentiment for September are due in the New York

session.

At 8:00 am ET, the Bank of England Deputy Governor Jon Cunliffe

will speak at the Single Resolution Board Conference at

Brussels.

At 8:30 am ET, BOE Deputy Governor Ben Broadbent participate in

a panel discussion titled "The future of central bank independence"

at the Bank of England's conference celebrating 20 years of

independence, in London

At 11:00 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker speaks about the economic outlook and financial

technology at the Fintech conference hosted by the Federal Reserve

Bank of Philadelphia.

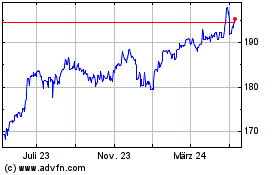

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

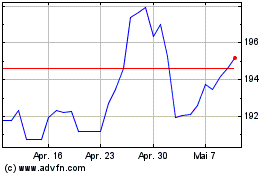

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Apr 2023 bis Apr 2024