EUROPE MARKETS: European Stocks End Lower, But Fiat Chrysler And Maersk Shine

21 August 2017 - 6:13PM

Dow Jones News

By Carla Mozee, MarketWatch

Renewed U.S.-North Korea tensions, Jackson Hole meeting on

investors' minds

European stocks closed lower Monday as investors grappled with

renewed U.S.-North Korea tensions, but deal news helped lift shares

of Danish conglomerate A.P. Moeller-Maersk A/S and Fiat Chrysler

Automobiles NV.

The Stoxx Europe 600 index fell 0.4% to finish at 372.72,

falling for a third session in a row and adding to Friday's loss of

0.7%

(http://www.marketwatch.com/story/spanish-stocks-lead-european-selloff-after-deadly-terrorists-attack-in-barcelona-2017-08-18)

that came after terrorist attacks in Spain.

Monday's slump came as the U.S. and South Korea kicked off

annual military exercises

(http://www.marketwatch.com/story/tensions-expected-to-rise-as-us-south-korea-start-annual-war-games-2017-08-20),

bringing tensions between the U.S. and North Korea back into focus.

Pyongyang warned on Sunday that the maneuvers are "reckless

behavior, driving the situation into the uncontrollable phase of a

nuclear war."

The "start of military exercises between America and South Korea

could spark a return to the kind of market-dragging nuclear

rhetoric seen a few weeks ago," wrote Spreadex financial analyst

Connor Campbell.

Stock movers: But investors did have corporate developments to

consider Monday. Maersk (MAERSK-B.KO) jumped 2.9% after the

shipping heavyweight reached a deal to sell its oil and gas

business for $7.45 billion to French oil producer Total SA

(http://www.marketwatch.com/story/total-buys-maersk-oil-unit-in-745-billion-deal-2017-08-21)(TOT).

Total shares finished 0.3% higher.

Shares in Tullow Oil PLC (TLW.LN) gained 3.2% after Total became

a partner in a Kenyan oil project through its acquisition of

Maersk's energy business. Barclays analysts said Total will bring a

"new dynamic" to the Kenyan project, a Dow Jones Newswires report

said.

Fiat shares (FCA.MI) (FCA.MI) climbed 6.9% after Reuters

reported

(http://www.marketwatch.com/story/chinese-auto-maker-interested-in-buying-fiat-reuters-2017-08-21)

that China's Great Wall Motor Co. (2333.HK) had expressed interest

in buying the Italian-American car maker. An earlier report by

Automotive News

(http://www.autonews.com/article/20170821/GLOBAL03/170829942/china-great-wall-jeep)

said Great Wall Motor was interested in Fiat's Jeep brand.

National indexes: France's CAC 40 index fell 0.5% to close at

5,087.59, and Germany's DAX 30 index lost 0.8% to finish at

12,065.99.

The U.K.'s FTSE 100 index dropped 0.1% to end at 7,318.88.

Central banks in focus: Investors are already looking ahead to

the U.S. Federal Reserve's central bank symposium in Jackson Hole,

Wyo., which starts Thursday.

"Many leaders, including the Federal Reserve Chairwoman Janet

Yellen and the European Central Bank President Mario Draghi will

speak about growth, inflation and changes in trade relations due to

Trump policies. Yet, no significant policy messages are expected,"

said LCG's senior market analyst Ipek Ozkardeskaya.

ECB chief Draghi will be watched for any signal that the bank

has developed a scenario for winding down monetary easing. On

Monday, the euro bought $1.1814, up from $1.1762 late Friday in New

York.

Read:Euro slides after ECB hints at no hawkish shift at Jackson

Hole

(http://www.marketwatch.com/story/euro-slides-after-ecb-hints-at-no-hawkish-shift-at-jackson-hole-2017-08-16)

(END) Dow Jones Newswires

August 21, 2017 11:58 ET (15:58 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

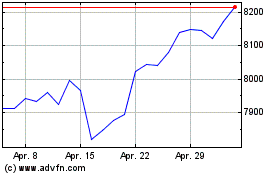

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024