Current Report Filing (8-k)

29 Juni 2017 - 11:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 29, 2017 (June 27, 2017)

DELEK US HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

001-32868

(Commission File Number)

|

52-2319066

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

7102 Commerce Way

Brentwood, Tennessee

(Address of principal executive offices)

|

37027

(Zip Code)

|

Registrant's telephone number, including area code:

(615) 771-6701

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On June 27, 2017, Delek US Holdings, Inc. (the “Company”) terminated the employment of Mark D. Smith, an Executive Vice President and named executive officer of the Company. In connection with such termination, on June 27, 2017, the Company entered into a Separation Agreement with Mr. Smith which provides for payment of the severance benefits to which Mr. Smith is entitled pursuant to his employment agreement with the Company, sets forth Mr. Smith’s general release of claims against the Company and its affiliates and provides for Mr. Smith’s resignation of officer and director positions with entities affiliated with the Company.

|

|

|

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

On June 29, 2017, the Company held a special meeting of the Company’s stockholders (the “Special Meeting”) to consider and vote on proposals to: (i) approve the issuance of shares of Delek Holdco, Inc. common stock, par value $0.01 per share, to the stockholders of Alon USA Energy, Inc. (other than the Company and any subsidiary of the Company), as consideration in connection with the merger by and between Alon USA Energy, Inc. and Astro Mergeco, Inc. contemplated by that certain Agreement and Plan of Merger dated as of January 2, 2017, by and among the Company, Alon USA Energy, Inc., Delek Holdco, Inc., Dione Mergeco, Inc., and Astro Mergeco, Inc., as amended; and (ii) adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the proposal described in clause (i) above.

The proposals are described in detail in the joint proxy statement/prospectus filed with the Securities and Exchange Commission by the Company on

May 30, 2017.

As of the close of business on May 26, 2017, the record date for the Special Meeting, there were 62,032,476 shares of the Company’s common stock outstanding and entitled to vote at the Special Meeting.

At the Special Meeting, holders of 49,133,209 shares of the Company’s common stock were present or represented by proxy, constituting a quorum.

A summary of the voting results for the proposals is set forth below:

1. The proposal to approve the issuance of shares of Delek Holdco, Inc. common stock to the stockholders of Alon USA Energy, Inc. (other than the Company and any subsidiary of the Company) as merger consideration was approved by the following vote:

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

48,827,068

|

284,383

|

21,758

|

0

|

2. The proposal to approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve the proposal listed above, was approved by the following vote:

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

45,294,952

|

3,627,472

|

210,785

|

0

|

Item 8.01. Other Events.

On June 29, 2017, the Company issued a press release announcing the results of the Special Meeting. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits

|

|

|

|

(a)

|

Financial statements of businesses acquired.

|

Not applicable.

|

|

|

|

(b)

|

Pro forma financial information.

|

Not applicable.

|

|

|

|

(c)

|

Shell company transactions.

|

Not applicable.

99.1 Press release dated June 29, 2017.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Dated: June 29, 2017

|

DELEK US HOLDINGS, INC.

|

|

|

|

|

|

/s/ Kevin Kremke

|

|

|

Name: Kevin Kremke

|

|

|

Title: EVP / Chief Financial Officer

|

EXHIBIT INDEX

Exhibit No.

Description

99.1 Press Release dated June 29, 2017.

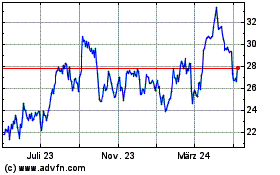

Delek US (NYSE:DK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

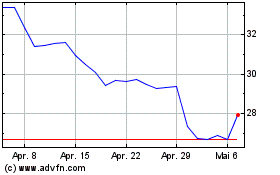

Delek US (NYSE:DK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024