Aussie Rises As Australia Unemployment Rate Falls

18 Mai 2017 - 4:14AM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Thursday, after data showed that

jobless rate in Australia fell more than expected in April.

Data from the Australian Bureau of Statistics showed that the

jobless rate in the country was a seasonally adjusted 5.7 percent

in April. That beat forecasts for 5.9 percent, which would have

been unchanged from the March reading.

The Australian economy added 37,400 jobs to total 12,099,300 in

April. That was well above expectations for a gain of 5,000 jobs

following the downwardly revised addition of 60,000 jobs in the

previous month.

Full-time employment decreased 11,600 to 8,227,400 and part-time

employment increased 49,000 to 3,871,900.

In other economic news, data from the Melbourne Institute showed

that consumer prices in Australia are predicted to have risen 4.0

percent on year in May. That's down from 4.1 percent in April, and

it moves further off of January's multi-year high reading of 4.3

percent.

The Australian Bureau of Statistic's official read on inflation

for the first quarter of 2017 was 2.1 percent on year.

Wednesday, the Australian dollar had fallen 0.05 percent against

the U.S. dollar, 1.96 percent against the yen, 0.62 percent against

the euro, 0.04 percent against the loonie, and 0.77 percent against

the kiwi.

In the Asian trading, the Australian dollar rose to near 2-week

high of 0.7467 against the U.S. dollar and 1.0163 against the

Canadian dollar, from yesterday's closing quotes of 0.7431 and

1.0108, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 0.76 against the greenback and

1.02 against the loonie.

Against the euro, the yen and the NZ dollar, the aussie advanced

to 1.4922, 83.00 and 1.0773 from an early 8-month low of 1.5075,

nearly a 4-week low of 82.11 and a 1-week low of 1.0692,

respectively. The aussie may test resistance around 1.46 against

the euro, 85.00 against the yen, and 1.09 against the kiwi.

In the scheduled events today, U.K. retail sales data for April

is due to be released at 4:30 am ET.

At 3:50 am ET, ECB Executive Board Member Yves Mersch and

Bundesbank President Jens Weidmann will deliver speeches at a

symposium on payment systems of the Bundesbank, in Frankfurt.

At 7:00 am ET, Lorie Logan Senior Vice President at Federal

Reserve Bank is expected to speak at the "Remarks by Lorie Logan",

in New York.

In the New York session, U.S. jobless claims for the week ended

May 13 and U.S. leading indicators for April are slated for

release.

At 8:30 am ET, European Central Bank Executive Board Member Yves

Mersch will give Keynote presentation at Government Borrowers Forum

hosted by the European Stability Mechanism and the Ministry of

Finance of Luxembourg, in Luxembourg.

At 8:45 am ET, ECB Board Member Sabine Lautenschlager is

expected to deliver a speech at the IBF Board meeting in

Berlin.

At 1:00 pm ET, European Central Bank President Mario Draghi is

expected to speak at the University of Tel Aviv.

At 1:15 pm ET, Federal Reserve Bank of Cleveland President

Loretta Mester is expected to speak on Economy and Monetary Policy

before the Economic Club of Minnesota.

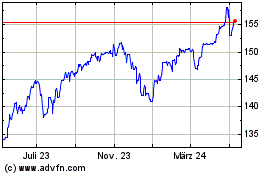

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

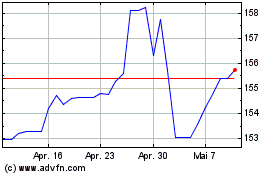

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024