Salesforce Primes $100 Million For New Startup Fund

02 Mai 2017 - 2:29PM

Dow Jones News

By Jay Greene

Salesforce.com Inc. is pumping $100 million into its fourth

investment fund, aimed at helping startups develop apps that work

with its business software services.

Salesforce Ventures, the company's corporate investment arm,

launched the new Salesforce Platform Fund on Tuesday to support

early-stage companies, with the goal of "building an ecosystem of

partners around us, " said John Somorjai, executive vice president

of corporate development and Salesforce Ventures.

Salesforce is among several tech companies with venture funds

that invest in startups for varying reasons. The venture arms of

Salesforce, Qualcomm Inc. and Microsoft Corp. tend to focus more on

the strategic return to their respective companies. Others, such as

Intel Capital and Alphabet Inc.'s GV, are set up like traditional

venture-capital funds with the chief goal of delivering financial

returns.

More generally, corporate venture capital has gained popularity

in recent years as old-line companies have sought to keep up with

shifts in technology. Boeing Co., Kellogg Co. and Campbell Soup Co.

have all set up venture funds in the past year.

Past Salesforce investments include Web-storage company Box

Inc., document-sharing startup DocuSign Inc., and communications

software maker Twilio Inc., all of which have services that run on

Salesforce's cloud-computing platform. The company has invested in

more than 200 startups since 2009, with nearly 50 of those being

acquired and eight holding initial public offerings.

Salesforce focuses on startups that already have customers, Mr.

Somorjai said. The company's investments, made alongside

venture-capital firms, have ranged between $250,000 and $10

million. Salesforce takes ownership stakes under 10% and doesn't

seek board seats.

The new fund aims to provide a boost to companies fueling

Salesforce's growth. The company recently stepped up efforts to

weave artificial intelligence into its services, and that interest

will carry over to its investments.

Salesforce Ventures doesn't disclose its financial returns, but

a company regulatory filing noted that the fair-market value of its

privately held investments as of Jan. 31 was $758.3 million, and

that included $232.3 million in unrealized gains.

Salesforce's previous three funds have invested in mobile

technology, European startups and businesses focused on the

company's software-development platform. Mr. Somorjai expects to

spend the $100 million earmarked for the new fund within two

years.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

May 02, 2017 08:14 ET (12:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

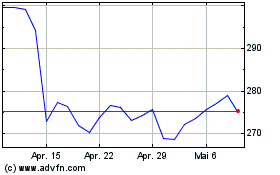

Salesforce (NYSE:CRM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024