Australian Dollar Drops After RBA Minutes

21 März 2017 - 3:52AM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Tuesday, as investors digested

the minutes of the Reserve Bank of Australia's March meeting.

Minutes from the bank's March 7 meeting revealed that members of

the Reserve Bank of Australia's monetary policy board expected to

see consumer prices continue to rise, albeit at a gradual pace.

The members noted that the Australian economy is continuing to

move away from a focus on mining investment, in spite of a mild

rebound in commodity prices, the minutes showed.

In other economic news, the Australian Bureau of Statistics said

that house prices in Australia advanced 4.1 percent on quarter in

the fourth quarter of 2016. That beat forecasts for a gain of 2.5

percent following the 1.5 percent increase in the third

quarter.

On a yearly basis, prices spiked 7.7 percent, again beating

estimates for 6.3 percent and up from 3.5 percent in the three

months prior.

Meanwhile, crude oil futures edged lower amid reports that OPEC

may extend its supply quota experiment beyond this year.

Monday, the Australian dollar had risen 0.38 percent against the

U.S. dollar, 0.03 percent against the yen, 0.27 percent against the

euro and 0.37 percent against the Canadian dollar. Meanwhile, the

aussie dropped against the NZ dollar.

In the Asian trading, the Australian dollar fell to a 6-day low

of 1.0929 against the NZ dollar and a 4-day low of 1.3967 against

the euro, from yesterday's closing quotes of 1.0956 and 1.3893,

respectively. If the aussie extends its downtrend, it is likely to

find support around 1.08 against the kiwi and 1.41 against the

euro.

Against the U.S. dollar, the yen and the Canadian dollar, the

aussie slipped to 0.7701, 86.79 and 1.0282 from yesterday's closing

quotes of 0.7727, 86.99 and 1.0320, respectively. The aussie may

test support near 0.75 against the greenback, 86.00 against the yen

and 1.01 against the loonie. Looking ahead, Swiss SECO economists

forecasts for March is due to be released in the pre-European

session at 2:45 am ET.

Swiss trade data for February, U.K. consumer price, producer

price and retail price indexes for February, house price index for

January and public sector finance data for February are slated for

release later in the day.

At 6:00 am ET, Federal Reserve Bank of New York President

William Dudley and Bank of England Governor Mark Carney are

expected to participate in a panel discussion about ethics and

culture in banking at the Bank of England, in London.

At 7:45 am ET, Federal Reserve Deputy Director for Division of

Bank Supervision and Regulation Maryann Hunter will attend American

Bankers Association's Government Relations Summit in

Washington.

In the New York session, Canada retail sales data is set to be

published.

At 12:00 pm ET, Federal Reserve Bank of Kansas City President

Esther George is expected to speak on the U.S. economy and the

Federal Reserve before an event hosted by Women in Housing and

Finance, in Washington.

At 3:45 pm ET, Bank of Canada Deputy Governor Lawrence Schembri

will deliver a speech at the Greater Vancouver Board of Trade.

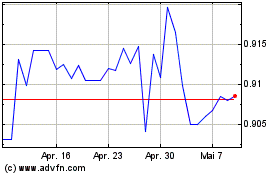

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Apr 2023 bis Apr 2024