GM's Barra Signals Concern About Tax Proposals Affecting Imports

28 Februar 2017 - 11:22PM

Dow Jones News

By William Mauldin

WASHINGTON -- General Motors Co. Chief Executive Mary Barra said

Tuesday that tax proposals affecting imports could be "problematic"

for the auto maker.

So far, there is little clarity on what Congress will do. House

Republicans have proposed a so-called border adjustment -- taxing

imports but not exports -- as part of a plan to cut the corporate

tax rate. President Donald Trump hasn't backed or rejected that

plan; he has talked about a "big border tax" targeted at companies

that move jobs outside the U.S. and then ship products back in.

Either plan could be damaging to GM.

Corporate executives across industries have been eyeing the tax

debate nervously. Mr. Trump may discuss a tax overhaul later

Tuesday during his first formal address to Congress.

Tax proposals, "if not done very thoughtfully, could be

problematic," Ms. Barra said at the Economic Club of Washington.

"It would take a period of time to make adjustments to that."

Mr. Trump discussed the tax plan with Ms. Barra and other

executives earlier in February at a meeting of a business-advisory

committee. "We had a very productive meeting," Ms. Barra said

Tuesday.

"We support tax reform, but it's got to be done in a way that

doesn't have unintended consequences," Ms. Barra said.

GM and other global manufacturers based in the U.S. are paying

careful attention as Mr. Trump and lawmakers discuss a variety of

policies that could reshape their business models. Mr. Trump has

warned about broad tariffs against Mexico and other trading

partners, special taxes that would target companies moving

production offshore and an overhaul of the North American Free

Trade Agreement, or Nafta.

Analysts say a border-adjusted tax could hurt GM more than other

Detroit car makers because it brings in more products from Mexico,

including the import of nearly 400,000 full-size pickups in 2016.

The trucks account for the bulk of GM's global profits. Ford Motor

Co. imports small cars from Mexico but makes its lucrative F-series

pickups in the U.S.

GM also relies on parts made by its suppliers south of the

border. Trump advisers have said they may change Nafta. rules that

govern how much of a vehicle must be made in North American to

qualify for duty-free trade across the borders with Mexico and

Canada.

A border tax could change the calculus companies use when

determining where to source components from around the world.

Before any major changes are implemented, executives are looking to

explain their reliance on international supply chains to U.S.

officials and lawmakers and request a delay.

Such policy shifts can affect where a company assembles cars or

other products and even what domestic and international businesses

are worth owning.

GM has entered talks to sell its European business Opel to

Peugeot, part of a process of shedding money-losing operations

abroad. The French government holds a 14% stake in Peugeot,

formally known as Groupe PSA SA.

Ms. Barra said Tuesday the companies are "exploring other

opportunities to see if we can work together."

"We've done a lot to improve the business, but we're exploring

opportunities," she said of Opel.

--Mike Colias and Richard Rubin contributed to this article.

Write to William Mauldin at william.mauldin@wsj.com

(END) Dow Jones Newswires

February 28, 2017 17:07 ET (22:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

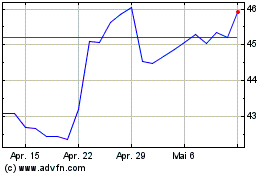

General Motors (NYSE:GM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

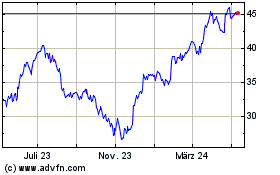

General Motors (NYSE:GM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024