Salesforce Sees Deferred Revenue Climb

28 Februar 2017 - 11:10PM

Dow Jones News

By Jay Greene

Salesforce.com Inc. posted a 29% jump in deferred revenue for

its fiscal fourth quarter, a sign the business-software company

continues to rack up customers moving computing operations to the

cloud.

Because Salesforce relies on subscriptions of its web-based,

on-demand software, deferred revenue better reflects the company's

prospects than does overall revenue.

Deferred revenue, which consists primarily of billings received

in advance for subscription services, rose to $5.54 billion. Nomura

Securities Co. analyst Frederick Grieb had forecast

deferred-revenue growth of 22%.

In constant currency, a measurement used to eliminate the

effects of exchange-rate fluctuations, deferred revenue also

climbed 29%.

Revenue from Sales Cloud, the company's flagship sales-force

automation business, rose 13.5% to $804.9 million.

Its Service Cloud business, which helps companies run

customer-service operations, generated $615.3 million in revenue, a

24.2% gain. And Salesforce's Marketing Cloud, used for email and

advertising campaigns, posted $298.8 million in revenue, up

62.3%.

Salesforce posted $51.4 million in net loss, or 7 cents a share

for the quarter that ended Jan. 31, compared with a loss of $25.5

billion, or 4 cents a share, a year ago.

Excluding the impact of items, such as amortization and

stock-based compensation, adjusted earnings rose to 28 cents from

19 cents a year earlier. Analysts surveyed by Thomson Reuters were

forecasting adjusted earnings of 25 cents a share. Revenue gained

26.8% to $2.29 billion, compared with analysts forecasts of $2.28

billion

Shares fell 0.97% to $80.64 in after-hours trading as per-share

earnings and revenue beat expectations.

Annual revenue hit $8.39 billion, a 26% gain. Three months ago,

the company said it would reach $10 billion in annual revenue by

January 2018, setting a time frame for reaching one of its

longstanding goals. For the current quarter the company projected

revenue between $2.34 billion and $2.35 billion with income on a

per-share basis in the range of loss between 2 and 3 cents, with

adjusted earnings between 25 cents and 26 cents. Analysts expected

$2.37 billion in revenue and 30 cents in adjusted income on a

per-share basis.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

February 28, 2017 16:55 ET (21:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

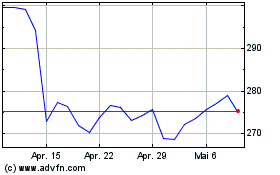

Salesforce (NYSE:CRM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024