U.S. Dollar Extends Drop

23 Januar 2017 - 2:26AM

RTTF2

The U.S. dollar continued to be weak against other major

currencies in the Asian session on Monday in the wake of U.S.

President Donald Trump's protectionist tone in his inauguration

speech, hinting no detail on his plans to stimulate economic

growth.

Investors turned cautious after Trump's inaugural address, which

did not specify his economic policies, but sounded protectionist

after he pledged to lead an administration that puts America

first.

The president's remarks have been described as protectionist, as

he lamented U.S. policies that have enriched foreign industry and

subsidized the armies of other countries at the expense of

America's industry and military.

Last Friday, the U.S. dollar fell 0.29 percent against the euro,

0.29 percent against the pound, 0.51 percent against the Swiss

franc, and 0.24 percent against the yen.

In the Asian trading, the U.S. dollar fell to a 1-1/2-month low

of 1.0749 against the euro, a 5-week low of 1.2445 against the

pound, a 5-day low of 113.44 114.57 against the yen, and more than

a 2-month low of 0.9981 against the Swiss franc, from Friday's

closing quotes of 1.0698, 1.2374, 114.57 and 1.0009, respectively.

If the greenback extends its downtrend, it is likely to find

support around 1.11 against the euro, 1.28 against the pound,

108.00 against the yen, and 0.98 against the franc.

Against the Canadian dollar, the greenback dropped to a 4-day

low of 1.3281 from Friday's closing value of 1.3308. The greenback

is likely to find support around the 1.30 region.

Against the Australian and the New Zealand dollars, the

greenback edged down to 0.7579 and 0.7210 from last week's closing

quotes of 0.7552 and 0.7164, respectively. On the downside, 0.78

against the aussie and 0.74 against the kiwi are seen as the next

support level for the greenback.

Looking ahead, at 6:30 am ET, ECB President Mario Draghi will

deliver a speech on the occasion of the awarding of the Premio

Camillo Cavour organised by Fondazione Camillo Cavour in Turin,

Italy.

Canada wholesales data for November is due to be released at

8:30 am ET.

At 8:15 am ET, ECB Board Member Peter Praet delivers a speech at

"European Pillar of Social Rights Conference", organised by

European Commission in Brussels.

At 10:00 am ET, Eurozone consumer confidence for January is

slated for release.

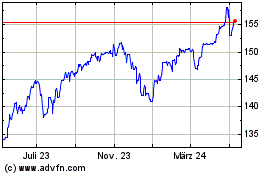

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

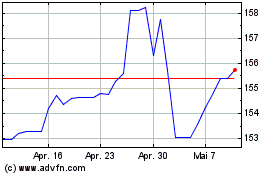

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024