Surgery Partners, Inc. (NASDAQ:SGRY) ("Surgery Partners" or

the "Company"), a leading provider of surgical services, today

announced results for the third quarter

ended September 30, 2016.

- Revenues increased 18.0% over third quarter 2015 to $282.7

million

- Same-facility revenue increased 10.3% over third quarter 2015

to $281.2 million

- Net loss attributable to Surgery Partners decreased to $2.3

million from $3.1 million in the third quarter 2015

- Adjusted EBITDA increased 12.3% over third quarter 2015 to

$44.7 million

- Diluted net loss per share of ($0.05) vs. ($0.10) in the third

quarter 2015

- Adjusted diluted net income per share of $0.21 vs. $0.02 in the

third quarter 2015

“Surgery Partners produced strong revenue growth for the third

quarter with an 18.0% increase over prior year driven by solid

same-facility revenue growth of 10.3%,” said Mike Doyle, Chief

Executive Officer. “We continue to demonstrate strong volume growth

as we add higher acuity cases to our surgical facilities and expand

services in our existing markets.”

“Our differentiated operating model strategically aligns

physicians in an outpatient setting through employment and

partnership opportunities. Our strategy provides for significant

growth potential as we provide solutions for independent

physicians, physician group practices, health systems and payors

pursing a path to value based care. We appreciate and respect the

efforts of our physicians and staff as they deliver high quality

healthcare in a setting that is convenient and more cost effective

for patients and payors.”

“Also, during the quarter we amended our First Lien Credit

Agreement reducing the applicable margin by 50 basis points and

resulting in an annual interest savings of approximately $5

million.”

Transaction Update

At the end of the quarter, the Company closed on four

transactions: an ambulatory surgery center in Louisiana, two

physician practices and an anesthesia practice. In addition,

the Company entered into a relationship with a health system in

Florida partnering with the system to implement their outpatient

strategy. “We are encouraged by the recent performance of our

facilities and our pipeline remains full,” commented Mike

Doyle. “We continue to see opportunities with both physician

practices which enhance our investments in existing markets and

surgical facilities which expand our presence in new markets.”

Third Quarter 2016 Results

Total revenues for the third quarter of 2016 increased 18.0% to

$282.7 million from $239.6 million for the third quarter of 2015.

Same-facility revenues for the third quarter of 2016 increased

10.3% to $281.2 million from $254.9 million in the same period last

year. Results were driven by increased same-facility cases of

4.3%.

For the third quarter of 2016, the Company’s net loss

attributable to Surgery Partners improved to $2.3 million compared

to $3.1 million for the same period last year. For the third

quarter of 2016, the Company’s Adjusted EBITDA increased 12.3% to

$44.7 million compared to Adjusted EBITDA of $39.9 million for the

same period last year.

Year To Date 2016 Results

Total revenues year to date 2016 increased 20.5% to $839.4

million from $696.6 million for the same period last year.

Same-facility revenues for year to date 2016 increased 12.8% to

$814.8 million from $722.2 million in the same period last

year. Results were driven by increased same-facility cases of

7.8%.

For year to date 2016, the Company’s net loss attributable to

Surgery Partners improved to $7.4 million compared to a net loss of

$15.3 million for the same period last year. For year to date 2016,

the Company’s Adjusted EBITDA increased 13.0% to $129.2 million

compared to Adjusted EBITDA of $114.3 million for the same period

last year.

Liquidity

At September 30, 2016, Surgery Partners had cash and cash

equivalents of $55.2 million and availability of $114.9 million

under its revolving credit facility. Net operating cash flow,

including operating cash flow less distributions to non-controlling

interests, was $1.7 million for the third quarter of 2016 or $19.1

million on an adjusted basis, excluding merger transaction and

integration costs, an accelerated interest payment in the quarter

related to the amendment of the First Lien Credit Agreement, and a

component of payments for acquisitions. The Company’s ratio of

total debt to EBITDA, as calculated under the Company’s credit

agreement, was 6.2x at the end of the third quarter of 2016.

Full Year 2016 Guidance

Surgery Partners affirms its full year 2016 revenue guidance at

the mid to high end of our original range to $1.12 billion to $1.14

billion, a 17.5% to 19.0% growth over 2015. The Company is

modifying its Adjusted EBITDA full year guidance to a 13.0% to

16.0% growth over 2015 with a range of $179 million to $184 million

from its prior range of $184 million to $191 million. This change

is due primarily to the timing of certain acquisitions which closed

later than anticipated, along with the impact from Hurricane

Matthew in the fourth quarter.

Conference Call Information

Surgery Partners will hold its conference call tomorrow,

November 10, 2016 at 8:30 a.m. (Eastern Time). The conference

call can be accessed live over the phone by dialing 1-877-705-6003,

or for international callers, 1-201-493-6725. A replay will be

available two hours after the call and can be accessed by dialing

1-844-512-2921, or for international callers, 1-412-317-6671. The

passcode for the live call and the replay is 13647890. The replay

will be available until November 24, 2016.

Interested investors and other parties may also listen to a

simultaneous webcast of the conference call by logging onto the

Investor Relations section of the Company's website at

www.surgerypartners.com. The on-line replay will remain

available for a limited time beginning immediately following the

call.

To learn more about Surgery Partners, please visit the company's

website at www.surgerypartners.com. Surgery Partners uses its

website as a channel of distribution for material Company

information. Financial and other material information

regarding Surgery Partners is routinely posted on the Company's

website and is readily accessible.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements, which have been included in reliance of

the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995, involve risks and uncertainties and assumptions

relating to our operations, financial condition, business,

prospects, growth strategy and liquidity, which may cause our

actual results to differ materially from those projected by such

forward-looking statements, and the Company cannot give assurances

that such statements will prove to be correct. You can identify

forward-looking statements because they do not relate strictly to

historical or current facts. These statements may include words

such as “aim,” “anticipate,” “believe,” “estimate,” “expect,”

“forecast,” “outlook,” “potential,” “project,” “projection,”

“plan,” “intend,” “seek,” “may,” “could,” “would,” “will,”

“should,” “can,” “can have,” “likely,” the negatives thereof and

other words and terms of similar meaning in connection with any

discussion of the timing or nature of future operating or financial

performance or other events.

The forward-looking statements appear in a number of places

throughout this press release and include statements regarding our

intentions, beliefs or current expectations concerning, among other

things, our results of operations, financial condition, liquidity,

prospects, growth, strategies and the industry in which we operate.

All forward-looking statements are subject to risks and

uncertainties, including but not limited to those risks and

uncertainties described in “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2015 that may cause

actual results to differ materially from those that we

expected.

The forward-looking statements made in this press release are

made only as of the date of the hereof. Except as required by law,

we undertake no obligation to update any forward-looking statement,

whether as a result of new information or otherwise. More

information about potential factors that could affect our business

and financial results is included in our filings with

the Securities and Exchange Commission.

Use of Non-GAAP Financial Measures

In addition to the results prepared in accordance with generally

accepted accounting principles in the United

States ("GAAP") provided throughout this press release,

Surgery Partners has presented the following non-GAAP financial

measures: Adjusted EBITDA and adjusted net income per share, which

exclude various items detailed in the attached "Reconciliation of

Non-GAAP Financial Measures".

These non-GAAP financial measures are not intended to replace

financial performance measures determined in accordance with GAAP.

Rather, they are presented as supplemental measures of the

Company's performance that management believes may enhance the

evaluation of the Company's ongoing operating results. These

non-GAAP financial measures are not presented in accordance with

GAAP, and the Company’s computation of these non-GAAP financial

measures may vary from those used by other companies. These

measures have limitations as an analytical tool, and should not be

considered in isolation or as a substitute or alternative to net

income or loss, operating income or loss, cash flows from operating

activities, total indebtedness, earnings per share or any other

measures of operating performance, liquidity or indebtedness

derived in accordance with GAAP.

About Surgery Partners

Headquartered in Nashville, Tennessee, Surgery Partners is a

leading healthcare services company with a differentiated

outpatient delivery model focused on providing high quality, cost

effective solutions for surgical and related ancillary care in

support of both patients and physicians. Founded in 2004, Surgery

Partners is one of the largest and fastest growing outpatient

surgical and ancillary services company in the country, with more

than 150 locations in 29 states, including surgical facilities,

physician practices and urgent care facilities.

| SURGERY PARTNERS, INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(Amounts in

thousands, except shares and per share

amounts)(Unaudited) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| |

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

282,682 |

|

|

$ |

239,599 |

|

|

$ |

839,437 |

|

|

$ |

696,569 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Salaries

and benefits |

|

85,724 |

|

|

66,072 |

|

|

266,401 |

|

|

188,405 |

|

|

Supplies |

|

65,907 |

|

|

60,377 |

|

|

196,484 |

|

|

176,550 |

|

|

Professional and medical fees |

|

20,856 |

|

|

17,233 |

|

|

60,813 |

|

|

48,144 |

|

| Lease

expense |

|

13,204 |

|

|

11,211 |

|

|

38,712 |

|

|

33,267 |

|

| Other

operating expenses |

|

15,703 |

|

|

13,928 |

|

|

44,539 |

|

|

39,786 |

|

| Cost of

revenues |

|

201,394 |

|

|

168,821 |

|

|

606,949 |

|

|

486,152 |

|

| General

and administrative expenses (includes acquisition compensation

expense of $1,530 and $3,060 in 2016, respectively) |

|

14,985 |

|

|

11,236 |

|

|

42,205 |

|

|

34,944 |

|

|

Depreciation and amortization |

|

9,713 |

|

|

8,611 |

|

|

28,984 |

|

|

25,538 |

|

| Provision

for doubtful accounts |

|

8,514 |

|

|

5,840 |

|

|

15,931 |

|

|

16,049 |

|

| Income

from equity investments |

|

(1,167 |

) |

|

(1,320 |

) |

|

(3,007 |

) |

|

(2,866 |

) |

| Loss

(gain) on disposal or impairment of long-lived assets, net |

|

572 |

|

|

1,161 |

|

|

1,697 |

|

|

(1,522 |

) |

| Loss on

debt refinancing |

|

3,595 |

|

|

— |

|

|

11,876 |

|

|

— |

|

| Merger

transaction and integration costs |

|

1,864 |

|

|

1,249 |

|

|

6,361 |

|

|

14,897 |

|

|

Electronic health records incentive income |

|

364 |

|

|

57 |

|

|

269 |

|

|

107 |

|

| Other

(income) expense |

|

— |

|

|

(330 |

) |

|

97 |

|

|

(356 |

) |

| Total

operating expenses |

|

239,834 |

|

|

195,325 |

|

|

711,362 |

|

|

572,943 |

|

| Operating

income |

|

42,848 |

|

|

44,274 |

|

|

128,075 |

|

|

123,626 |

|

| Tax receivable

expense |

|

(3,733 |

) |

|

— |

|

|

(3,733 |

) |

|

— |

|

| Interest expense,

net |

|

(26,475 |

) |

|

(26,573 |

) |

|

(74,863 |

) |

|

(78,507 |

) |

| Income

before income taxes |

|

12,640 |

|

|

17,701 |

|

|

49,479 |

|

|

45,119 |

|

| Income tax (benefit)

expense |

|

(1,694 |

) |

|

3,917 |

|

|

2,496 |

|

|

8,368 |

|

| Net

income |

|

14,334 |

|

|

13,784 |

|

|

46,983 |

|

|

36,751 |

|

| Less: Net income

attributable to non-controlling interests |

|

(16,672 |

) |

|

(16,906 |

) |

|

(54,392 |

) |

|

(52,061 |

) |

| Net loss

attributable to Surgery Partners, Inc. |

|

$ |

(2,338 |

) |

|

$ |

(3,122 |

) |

|

$ |

(7,409 |

) |

|

$ |

(15,310 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss

per share attributable to common stockholders |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.05 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.48 |

) |

| Diluted

(1) |

|

$ |

(0.05 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.48 |

) |

| Weighted average common

shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

48,019,652 |

|

|

32,054,089 |

|

|

48,018,706 |

|

|

32,054,089 |

|

| Diluted

(1) |

|

48,019,652 |

|

|

32,054,089 |

|

|

48,018,706 |

|

|

32,054,089 |

|

(1) The impact of potentially dilutive securities for the three

and nine months ended September 30, 2016 and

September 30, 2015 was not considered because the effect would

be anti-dilutive in each of those periods.

| SURGERY PARTNERS, INC. Unaudited

Selected Financial and Operating Data(Amounts in

thousands, except shares and per share

amounts) |

| |

| |

September 30, 2016 |

|

December 31, 2015 |

| |

|

|

|

| Balance Sheet

Data (at period end): |

|

|

|

| Cash and cash

equivalents |

$ |

55,209 |

|

|

$ |

57,933 |

|

| Total current

assets |

328,728 |

|

|

310,957 |

|

| Total assets |

2,248,725 |

|

|

2,104,443 |

|

| |

|

|

|

| Current maturities of

long-term debt |

29,105 |

|

|

27,247 |

|

| Total current

liabilities |

178,654 |

|

|

181,289 |

|

| Long-term debt, less

current maturities |

1,357,824 |

|

|

1,228,112 |

|

| Total liabilities |

1,748,950 |

|

|

1,623,077 |

|

| |

|

|

|

| Total Surgery Partners,

Inc. stockholders' deficit |

(8,331 |

) |

|

(4,028 |

) |

| Non-controlling

interests--non-redeemable |

325,808 |

|

|

301,955 |

|

| Total stockholders'

equity |

317,477 |

|

|

297,927 |

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| |

|

|

|

|

|

|

|

| Cash Flow

Data: |

|

|

|

|

|

|

|

| Net cash provided by

(used in): |

|

|

|

|

|

|

|

| Operating

activities |

$ |

18,826 |

|

|

$ |

29,306 |

|

|

$ |

92,863 |

|

|

$ |

60,292 |

|

| Investing

activities |

(21,028 |

) |

|

(26,742 |

) |

|

(154,395 |

) |

|

(39,484 |

) |

| Capital

expenditures |

(8,027 |

) |

|

(6,569 |

) |

|

(28,377 |

) |

|

(18,115 |

) |

|

Investments in new businesses |

(13,001 |

) |

|

(20,499 |

) |

|

(126,018 |

) |

|

(32,562 |

) |

| Financing

activities |

5,812 |

|

|

6,377 |

|

|

58,808 |

|

|

(38,880 |

) |

|

Distributions to non-controlling interests |

(17,081 |

) |

|

(18,819 |

) |

|

(49,443 |

) |

|

(51,195 |

) |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Other

Data: |

|

|

|

|

|

|

|

| Number of surgical

facilities as of the end of period |

104 |

|

|

99 |

|

|

104 |

|

|

99 |

|

| Number of consolidated

surgical facilities as of the end of period |

93 |

|

|

88 |

|

|

93 |

|

|

88 |

|

| Cases |

106,821 |

|

|

97,902 |

|

|

315,508 |

|

|

286,961 |

|

| Revenue per case |

$ |

2,646 |

|

|

$ |

2,447 |

|

|

$ |

2,661 |

|

|

$ |

2,427 |

|

| Adjusted EBITDA |

$ |

44,748 |

|

|

$ |

39,857 |

|

|

$ |

129,205 |

|

|

$ |

114,299 |

|

| Adjusted EBITDA as a % of

revenues |

15.8 |

% |

|

16.6 |

% |

|

15.4 |

% |

|

16.4 |

% |

| Adjusted EPS- Basic |

$ |

0.21 |

|

|

$ |

0.02 |

|

|

$ |

0.48 |

|

|

$ |

0.06 |

|

| Adjusted EPS- Diluted |

$ |

0.21 |

|

|

$ |

0.02 |

|

|

$ |

0.47 |

|

|

$ |

0.06 |

|

| SURGERY PARTNERS, INC. Supplemental

Information(Unaudited, in thousands, except cases

and growth rates) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Same-facility

Information(2): |

|

|

|

|

|

|

|

| Cases |

107,450 |

|

|

103,065 |

|

|

317,126 |

|

|

294,044 |

|

| Case growth |

4.3 |

% |

|

|

N/A |

|

|

|

7.8 |

% |

|

|

N/A |

|

| Revenue per case |

$ |

2,617 |

|

|

$ |

2,473 |

|

|

$ |

2,569 |

|

|

$ |

2,456 |

|

| Revenue per case

growth |

5.8 |

% |

|

|

N/A |

|

|

|

4.6 |

% |

|

|

N/A |

|

(2) Same-facility revenue includes revenues from our

consolidated and non-consolidated surgical facilities (excluding

facilities acquired in new markets or divested during the current

and prior periods) along with the revenues from our ancillary

services comprised of a diagnostic laboratory, multi-specialty

physician practices, urgent care facilities, anesthesia services,

optical services and specialty pharmacy services that complement

our surgical facilities in our existing markets.

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Segment

Revenues: |

|

|

|

|

|

|

|

| Surgical facility

services |

$ |

256,795 |

|

|

$ |

219,631 |

|

|

$ |

766,248 |

|

|

$ |

643,900 |

|

| Ancillary services |

22,684 |

|

|

16,347 |

|

|

62,967 |

|

|

41,557 |

|

| Optical services |

3,203 |

|

|

3,621 |

|

|

10,222 |

|

|

11,112 |

|

| Total

revenues |

$ |

282,682 |

|

|

$ |

239,599 |

|

|

$ |

839,437 |

|

|

$ |

696,569 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During the second quarter of 2016, the Company reassessed its

segment reporting and realigned the disclosures to reflect the

review and decision making made by the Chief Operating Decision

Maker (“CODM”). The purpose of these changes was to replace

operating income with adjusted EBITDA as the primary profit/loss

metric reviewed by the CODM in making key business decisions and on

allocation of resources. The Company has revised the segment

disclosures below to replace operating income with adjusted EBITDA

and has provided a reconciliation from adjusted EBITDA back to net

income in the reported condensed consolidated financial

information. These changes had no effect on the Company’s

reportable segments, which are presented consistent with prior

periods.

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Segment

Adjusted EBITDA: |

|

|

|

|

|

|

|

| Surgical facility

services |

$ |

53,347 |

|

|

$ |

44,031 |

|

|

$ |

153,318 |

|

|

$ |

129,337 |

|

| Ancillary services |

2,573 |

|

|

4,957 |

|

|

9,141 |

|

|

13,257 |

|

| Optical services |

1,276 |

|

|

929 |

|

|

3,004 |

|

|

3,120 |

|

| Total

segment adjusted EBITDA (3) |

$ |

57,196 |

|

|

$ |

49,917 |

|

|

$ |

165,463 |

|

|

$ |

145,714 |

|

| |

|

|

|

|

|

|

|

| General and

administrative expenses |

$ |

(14,985 |

) |

|

$ |

(11,236 |

) |

|

$ |

(42,205 |

) |

|

$ |

(34,944 |

) |

| Non-cash stock

compensation expense |

691 |

|

|

426 |

|

|

1,326 |

|

|

1,279 |

|

| Contingent acquisition

compensation expense |

1,530 |

|

|

— |

|

|

3,060 |

|

|

— |

|

| Management fee (4) |

— |

|

|

750 |

|

|

— |

|

|

2,250 |

|

| Acquisition related

costs |

316 |

|

|

— |

|

|

1,561 |

|

|

— |

|

| |

|

|

|

|

|

|

|

| Total adjusted EBITDA

(3) |

$ |

44,748 |

|

|

$ |

39,857 |

|

|

$ |

129,205 |

|

|

$ |

114,299 |

|

| |

|

|

|

|

|

|

|

| Net income attributable

to non-controlling interests |

$ |

16,672 |

|

|

$ |

16,906 |

|

|

$ |

54,392 |

|

|

$ |

52,061 |

|

| Depreciation and

amortization |

(9,713 |

) |

|

(8,611 |

) |

|

(28,984 |

) |

|

(25,538 |

) |

| Interest and other

expense, net |

(26,475 |

) |

|

(26,573 |

) |

|

(74,863 |

) |

|

(78,507 |

) |

| Income tax benefit

(expense) |

1,694 |

|

|

(3,917 |

) |

|

(2,496 |

) |

|

(8,368 |

) |

| Non-cash stock

compensation expense |

(691 |

) |

|

(426 |

) |

|

(1,326 |

) |

|

(1,279 |

) |

| Contingent acquisition

compensation expense |

(1,530 |

) |

|

— |

|

|

(3,060 |

) |

|

— |

|

| Management fee (4) |

— |

|

|

(750 |

) |

|

— |

|

|

(2,250 |

) |

| Merger transaction,

integration and practice acquisition costs |

(2,471 |

) |

|

(1,541 |

) |

|

(8,579 |

) |

|

(15,189 |

) |

| (Loss) gain on disposal

or impairment of long-lived assets, net |

(572 |

) |

|

(1,161 |

) |

|

(1,697 |

) |

|

1,522 |

|

| Tax receivable

agreement expense |

(3,733 |

) |

|

— |

|

|

(3,733 |

) |

|

— |

|

| Loss on debt

extinguishment |

(3,595 |

) |

|

— |

|

|

(11,876 |

) |

|

— |

|

| Total net

income |

$ |

14,334 |

|

|

$ |

13,784 |

|

|

$ |

46,983 |

|

|

$ |

36,751 |

|

(3) The above table reconciles adjusted EBITDA by segment to net

income as reflected in the unaudited condensed consolidated

statements of operations.

When we use the term “Adjusted EBITDA,” we are referring to net

income minus (a) net income attributable to non-controlling

interests plus (b) income tax (benefit) expense, (c) interest

and other expense, net, (d) depreciation and amortization, (e)

management fee, (f) merger transaction, integration and practice

acquisition costs, (g) non-cash stock compensation expense, (h)

loss on debt refinancing, (i) contingent acquisition compensation

expense (j) tax receivable agreement expense and (k) (gain) loss on

disposal of investments and long-lived assets. Non-controlling

interests represent the interests of third parties, such as

physicians, and in some cases, healthcare systems that own an

interest in surgical facilities that we consolidate for financial

reporting purposes. Our operating strategy is to apply a

market-based approach in structuring our partnerships with

individual market dynamics driving the structure. We believe that

it is helpful to investors to present Adjusted EBITDA as defined

above because it excludes the portion of net income attributable to

these third-party interests and clarifies for investors our portion

of Adjusted EBITDA generated by our surgical facilities and other

operations.

We use Adjusted EBITDA as a measure of liquidity. We have

included it because we believe that it provides investors with

additional information about our ability to incur and service debt

and make capital expenditures.

Adjusted EBITDA is not a measurement of financial performance or

liquidity under GAAP. It should not be considered in

isolation or as a substitute for net income, operating income, cash

flows from operating, investing or financing activities, or any

other measure calculated in accordance with generally accepted

accounting principles. The items excluded from Adjusted

EBITDA are significant components in understanding and evaluating

financial performance and liquidity. Our calculation of Adjusted

EBITDA may not be comparable to similarly titled measures reported

by other companies.

(4) Fee payable pursuant the Management and Investment

Advisory Services Agreement between the Company and Bayside

Capital, Inc., which was terminated in connection with our IPO.

SURGERY PARTNERS, INC.

Reconciliation of Non-GAAP Financial

Measures(Unaudited, Amounts in thousands except

shares and per share amounts)

From time to time, the Company incurs certain non-recurring

gains or losses that are normally nonoperational in nature and that

it does not consider relevant in assessing its ongoing operating

performance. When significant, Surgery Partners’ management and

Board of Directors typically exclude these gains or losses when

evaluating the Company’s operating performance and in certain

instances when evaluating performance for incentive compensation

purposes. Additionally, the Company believes that some investors

and equity analysts exclude these or similar items when evaluating

the Company’s current or future operating performance and in making

informed investment decisions regarding the Company. Accordingly,

the Company provides adjusted net income per share attributable to

Surgery Partners, Inc. stockholders as a supplement to its

comparable GAAP measure of net income per share attributable to

Surgery Partners, Inc. Adjusted net income per share attributable

to Surgery Partners, Inc. stockholders should not be considered as

a measure of financial performance under GAAP, and the items

excluded from adjusted net income per share attributable to Surgery

Partners, Inc. stockholders are significant components in

understanding and assessing financial performance. Adjusted net

income per share attributable to Surgery Partners, Inc.

stockholders should not be considered in isolation or as an

alternative to net income per share attributable to Surgery

Partners, Inc. stockholders as presented in the condensed

consolidated financial statements.

The following table reconciles net income as reflected in the

unaudited condensed consolidated statements of operations to

adjusted net income used to calculate adjusted net income per share

attributable to Surgery Partners, Inc. stockholders:

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| Consolidated

Statements of Operations Data: |

|

|

|

|

|

|

|

|

| Net

Income |

|

$ |

14,334 |

|

|

$ |

13,784 |

|

|

$ |

46,983 |

|

|

$ |

36,751 |

|

| Less: |

|

|

|

|

|

|

|

|

| Net

income attributable to non-controlling interest |

|

16,672 |

|

|

16,906 |

|

|

54,392 |

|

|

52,061 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

Management fee (4) |

|

— |

|

|

750 |

|

|

— |

|

|

2,250 |

|

| Merger

transaction, integration and practice acquisition costs |

|

2,471 |

|

|

1,541 |

|

|

8,579 |

|

|

15,189 |

|

| Non-cash

stock compensation expense |

|

691 |

|

|

426 |

|

|

1,326 |

|

|

1,279 |

|

|

Contingent acquisition compensation expense |

|

1,530 |

|

|

— |

|

|

3,060 |

|

|

— |

|

| Loss on

debt refinancing |

|

3,595 |

|

|

— |

|

|

11,876 |

|

|

— |

|

| Tax

receivable agreement expense |

|

3,733 |

|

|

— |

|

|

3,733 |

|

|

— |

|

| Loss

(gain) on disposal of investment and long-lived assets |

|

572 |

|

|

1,161 |

|

|

1,697 |

|

|

(1,522 |

) |

| Adjusted net

income |

|

$ |

10,254 |

|

|

$ |

756 |

|

|

$ |

22,862 |

|

|

$ |

1,886 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted net

income per share |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.21 |

|

|

$ |

0.02 |

|

|

$ |

0.48 |

|

|

$ |

0.06 |

|

|

Diluted |

|

$ |

0.21 |

|

|

$ |

0.02 |

|

|

$ |

0.47 |

|

|

$ |

0.06 |

|

| Weighted

average common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

48,019,652 |

|

|

32,054,089 |

|

|

48,018,706 |

|

|

32,054,089 |

|

|

Diluted |

|

48,329,783 |

|

|

33,871,990 |

|

|

48,197,585 |

|

|

33,859,482 |

|

Contact

Teresa Sparks, CFO

Surgery Partners, Inc.

(615) 234-8940

IR@surgerypartners.com

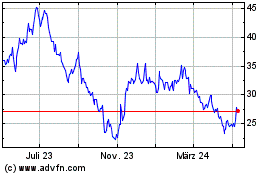

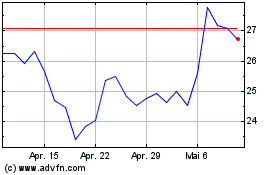

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024