AT&T Reports Drop in Wireless Phone Customers

23 Oktober 2016 - 4:53AM

Dow Jones News

By George Stahl and Thomas Gryta

AT&T Inc., in addition to announcing its $85.4 billion deal

to buy Time Warner Inc., reported its third-quarter financial

results Saturday, which provided a view into the reasons why the

company is seeking to diversify away from the U.S. wireless

business.

In the U.S., AT&T lost 268,000 mainstream wireless phone

customers. Phone additions are considered important because they

provide more service revenue than tablets, and customers with

postpaid phone accounts tend to stay longer. Including other

devices, AT&T added a total of 212,000 mainstream wireless

customers.

In all, AT&T's total wireless revenues dipped 0.7%, to $18.2

billion, which the company blamed on decreases in service and

equipment revenue.

The results came three days early as AT&T also announced on

Saturday its agreement to buy Time Warner Inc. The cash-and-stock

deal values Time Warner -- owner of CNN, TNT, HBO and the Warner

Bros. film and TV studio, among other things -- at $107.50 a share

and transforms AT&T into a media giant.

The Time Warner deal is seen helping AT&T potentially find

new areas of growth as its core wireless business has become

saturated and its share of the mobile market leaves little room for

acquisitions. In the competitive consumer wireless market, AT&T

has been focused on retaining its most profitable customers and

shying away from promotional offers to grab market share.

AT&T Chief Executive Randall Stephenson would head the new

company. The companies said Time Warner Chief Executive Jeff Bewkes

would stay for an interim period following the close of the deal to

help with the transition.

AT&T already is the biggest U.S. pay-television operator

after its $49 billion acquisition last year of DirecTV. The

company's video business lost a net 3,000 customers in the quarter

as additions in the DirecTV business failed to surpass the losses

in its older U-Verse pay television service.

AT&T has been pushing customers to the satellite service

since the DirecTV deal closed. AT&T lost almost 200,000 video

customers in that time but has said it would be net positive for

the year. It will now need to add 106,000 customers in the final

quarter of the year to meet that goal.

Over all, for the quarter ended Sept. 30, AT&T's earnings

increased to $3.33 billion, or 54 cents a share, from $2.99

billion, or 50 cents a share. Excluding certain costs -- such as

those for amortization and integration -- AT&T had per-share

earnings of 74 cents, flat from the year-ago period and in-line

with the average analyst estimate on Thomson Reuters.

Revenue rose 4.6% to $40.89 billion, below the average analyst

estimate of $41.15 billion on Thomson Reuters. The year-over-year

increase largely reflected the DirecTV acquisition. Excluding

DirecTV and foreign exchange, AT&T said revenue was essentially

flat, as growth in video and IP-based services mostly offset

pressures from declines in wireless and legacy services.

Along with its quarterly report, AT&T also raised its

quarterly dividend by 2.1%, to 49 cents from 48 cents, representing

its 33rd straight annual increase.

Write to George Stahl at george.stahl@wsj.com and Thomas Gryta

at thomas.gryta@wsj.com

(END) Dow Jones Newswires

October 22, 2016 22:38 ET (02:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

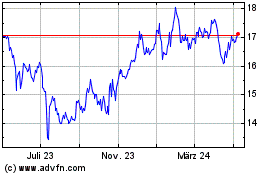

AT&T (NYSE:T)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

AT&T (NYSE:T)

Historical Stock Chart

Von Apr 2023 bis Apr 2024