Canadian Dollar Drops After Disappointing Canadian CPI, Retail Sales Reports

23 September 2016 - 11:25AM

RTTF2

The Canadian dollar slipped against its key counterparts in

European trading on Friday, after the release of downbeat data on

nation's retail sales for July and consumer price index for

August.

Data from Statistics Canada showed that Canada consumer prices

fell 0.2 percent on month, defying expectations for a 0.1 percent

rise. The index dropped 0.2 percent in the previous month.

Core CPI was unchanged on a monthly unadjusted basis, compared

to expectations for a 0.2 percent rise. The reading was flat in the

month of July also.

Separate data from the same agency showed that retail sales

edged down 0.1 percent to C$44.1 billion on a seasonally

adjusted month-on-month basis in July.

This follows a flat reading in June and confronted economists'

expectations for a 0.2 percent rise.

Core retail sales, excluding motor vehicle and parts dealers,

declined a seasonally adjusted 0.1 percent on month in July -

contradicting the 0.5 percent increase expected by economists and

follows a 0.6 percent slide last month.

Oil prices stabilized around $46 mark after Saudia Arabia

proposed to cut oil production in an attempt to stabilize the oil

markets, if Iran agrees to freeze its output this year. OPEC

members will meet on the sidelines of the International Energy

Forum, which meet next week in Algeria.

Crude for November delivery is currently down $0.15 to $46.17

per barrel.

The loonie showed mixed trading in the Asian session. While the

loonie held steady against the yen and the euro, it fell against

the greenback and the aussie.

The loonie dropped to a 2-day low of 1.3144 against the

greenback, compared to 1.3041 hit late New York Thursday. The

loonie may find support around the 1.33 mark.

Reversing from an early high of 77.49 against the Japanese yen,

the loonie weakened to 76.65. Continuation of the loonie's

downtrend may see it challenging support around the 75.00

region.

Survey from Nikkei showed that Japan's manufacturing sector

turned to expansion in September, with a manufacturing PMI score of

50.3.

That beat expectations for 49.2, and it was up from 49.5 in

August.

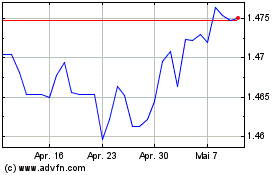

The loonie reversed from an early high of 1.4614 against the

euro and slipped to a 2-day low of 1.4752. The loonie is seen

finding support around the 1.48 zone.

Flash data from Markit showed that Eurozone private sector grew

at the slowest pace in 20 months in September.

The flash composite output index slid to 52.6 in September from

52.9 in August. Economists had expected the reading to fall

marginally to 52.8.

The loonie, having advanced to 0.9949 against the aussie at 7:15

am ET, eased immediately and touched a 1-1/2-month low of 1.0035.

If the loonie extends decline, it may locate 1.03 as the next

support level.

Looking ahead, Markit's U.S. flash manufacturing PMI for

September and U.S. Baker Hughes rig count data are slated for

release shortly.

At 9:00 am ET, U.S. Treasury Secretary Jack Lew and Treasury

Deputy Secretary Sarah Bloom Raskin will participate in the

Freedman Bank Forum in Washington.

At 12:00 pm ET, Federal Reserve Bank of Philadelphia President

Patrick Harker, Cleveland Fed President Loretta Mester and Atlanta

Fed President Dennis Lockhart are expected to participate in

"Presidents' Perspectives: The Fed's Role in Our Communities"

closing plenary before the "Reinventing Our Communities:

Transforming Our Economies," a conference hosted by the Federal

Reserve Bank of Philadelphia .

At 12:30 pm ET, Federal Reserve Bank of Dallas President Robert

Kaplan participates in moderated Q&A before the Independent

Bankers Association of Texas Annual Convention in San Antonio.

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Apr 2023 bis Apr 2024