Pound Falls Amid Risk Aversion

23 September 2016 - 7:05AM

RTTF2

The pound drifted lower against its key counterparts in European

morning deals on Friday, as European shares declined on profit

taking, following sharp gains in the previous session.

Data showing contraction in French economic growth for the

second quarter made investors nervous.

French GDP declined 0.1 percent from the first quarter, when it

advanced 0.7 percent, Insee reported. The preliminary estimate

showed a nil growth for the second quarter.

Oil prices drifted lower, amid uncertainty over the possibility

to clinch an agreement to freeze or slash output at next week's

OPEC meeting in Algeria.

Since there are no major economic reports coming out of the

U.S., traders will keep an eye on remarks by some Fed officials for

further clues on the rate outlook.

The pound has been trading in a negative territory against its

major counterparts, except the yen, in the Asian session.

The pound declined to a 3-day low of 0.8618 against the euro,

after having advanced to 0.8563 at 7:30 pm ET. The pound may find

support around the 0.87 mark.

Flash data from Markit showed that Eurozone private sector grew

at the slowest pace in 20 months in September.

The flash composite output index slid to 52.6 in September from

52.9 in August. A score above 50 indicates expansion. Economists

had expected the reading to fall marginally to 52.8.

Reversing from an early high of 1.3087 against the greenback,

the pound weakened to a 2-day low of 1.2998. The next possible

support for the pound may be located around the 1.28 region.

The pound, having advanced to 1.2684 against the Swiss franc at

8:00 pm ET, slipped to more than a 4-week low of 1.2613.

Continuation of the pound's downtrend may see it challenging

support around the 1.24 region.

The pound edged down to 131.06 against the Japanese yen, coming

off from an early high of 132.27. Further weakness may take the

pound to a support around the 129.00 area.

Survey from Nikkei showed that Japan's manufacturing sector

turned to expansion in September, with a manufacturing PMI score of

50.3.

That beat expectations for 49.2, and it was up from 49.5 in

August.

Looking ahead, Markit's U.S. flash manufacturing PMI for

September and U.S. Baker Hughes rig count data are slated for

release in the New York session.

At 9:00 am ET, U.S. Treasury Secretary Jack Lew and Treasury

Deputy Secretary Sarah Bloom Raskin will participate in the

Freedman Bank Forum, in Washington.

At 12:00 pm ET, Federal Reserve Bank of Philadelphia President

Patrick Harker, Cleveland Fed President Loretta Mester and Atlanta

Fed President Dennis Lockhart are expected to participate in

"Presidents' Perspectives: The Fed's Role in Our Communities"

closing plenary before the "Reinventing Our Communities:

Transforming Our Economies," a conference hosted by the Federal

Reserve Bank of Philadelphia .

At 12:30 pm ET, Federal Reserve Bank of Dallas President Robert

Kaplan participates in moderated Q&A before the Independent

Bankers Association of Texas Annual Convention, in San Antonio.

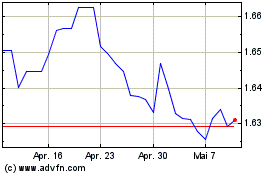

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Apr 2023 bis Apr 2024