Australian Dollar Advances After RBA Governor Lowe's Speech

22 September 2016 - 6:26AM

RTTF2

The Australian dollar climbed against its most major

counterparts in early European deals on Thursday, after the Reserve

Bank of Australia Governor Philip Lowe sounded upbeat on the

economy and reiterated that low interest rates are "not

particularly useful" to help lift growth.

In his first appearance before the parliamentary committee as

central bank governor, Lowe said that although inflation is

expected to remain low for some time, it would gradually pick up in

the light of strengthening labour market conditions.

"I believe we have reached the bottom of the interest rate

cutting cycle because we are seeing signs of stabilisation in

wages," he added.

"We have not seen our job as always keeping inflation tightly in

a narrow range," he told the House of Representatives Standing

Committee on Economics.

Although extraordinary actions taken by some central bank are

not intended to influence exchange rates, they have, inevitably

affected international capital flows and currency rates, Lowe

observed.

Due to such actions, foreign investors found Australian assets

attractive and influence the economy, he said.

The currency was also underpinned by higher commodities, buoyed

by a weaker dollar after the Fed decision to keep interest rates

unchanged and hinting at delaying interest rate rise till the end

of the year.

The currency has been trading higher against its major rivals,

except the U.S. dollar, in the Asian session.

The aussie strengthened to a 2-week high of 0.7666 against the

greenback, compared to Wednesday's closing value of 0.7621. The

aussie is likely to find resistance around the 0.79 mark.

The aussie climbed to 1.0437 against the NZ dollar, a level

unseen since August 30. The next possible resistance for the

aussie-kiwi pair is seen around the 1.055 region.

Reversing from an early low of 76.28 against the Japanese yen,

the aussie bounced off to 77.03. Continuation of the aussie's

uptrend may see it challenging resistance around the 78.00

level.

The aussie spiked up to a 2-week high of 1.4632 against the

European currency early in the Asian session and held steady

thereafter. The pair was worth 1.4670 when it finished Wednesday's

trading.

On the flip side, the aussie eased back to 0.9972 against the

loonie, around where it finished yesterday's trading.

Looking ahead, U.S. weekly jobless claims for the week ended

September 17, U.S. existing homes sales data for August, U.S. FHFA

house price index for July, U.S. leading indicators for August as

well as Eurozone consumer confidence index for September are slated

for release in the New York session.

At 9:00 am ET, European Central Bank President Mario Draghi,

Vice Presidents Valdis Dombrovskis and Vitor Constancio are

expected to speak at the European Systemic Risk Board annual

conference in Frankfurt.

At 9:30 am ET, Bank of England Deputy Governor Jon Cunliffe is

expected to participate in a panel discussion at the European

Systemic Risk Board in Frankfurt.

At 1:00 pm ET, Bank of England Governor Mark Carney will deliver

a presentation titled "Arthur Burns memorial lecture," in Berlin.

At the same time, BOE MPC Member Kristin Forbes will deliver a

speech at Imperial College in London.

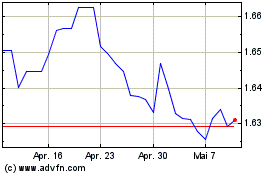

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Apr 2023 bis Apr 2024