$88.25 Million Ventura County Multifamily Sale Closed by Marcus & Millichap’s IPA Division

30 August 2016 - 8:41PM

Business Wire

Marcus & Millichap Capital Corp. arranged

$55.4 million in acquisition financing.

Marcus & Millichap (NYSE: MMI) today announced its

Institutional Property Advisors (IPA) division closed the sale of

IMT Westlake Village, a 253-unit multifamily community located in

Westlake Village, California. The $88.25 million sales price

equates to just under $319,000 per unit. Marcus & Millichap

Capital Corp. (MMCC) arranged $55.4 million in financing for the

purchase.

“Demand for high-quality multifamily housing in Westlake Village

and the surrounding submarkets is strong, as demonstrated by steady

rental rate increases over the last five years in every neighboring

submarket,” says Greg Harris, IPA executive director. “In fact,

premium rents in the area lead other Ventura County submarkets and

Los Angeles County as a whole.”

Harris, along with Kevin Green and Joseph Grabiec, IPA senior

directors, represented the seller, IMT Capital LLC, and procured

the buyer, a 1031-exchange investor. Danny Abergel, senior vice

president capital markets in MMCC’s Encino office, arranged the

financing.

“Sales and loans of this type are infrequent in the area, as the

neighborhoods are made up of mostly single-family homes,” adds

Abergel. “Marcus & Millichap’s integrated platform of brokerage

and financing provided key advantages that made the process move

smoothly and helped us close quickly.”

“Located in one of the most supply-constrained and coveted

locations in Los Angeles County, the property is well-positioned

for long-term future growth,” notes Green. “There is also a

significant value-add opportunity to be gained through completing

the apartment interior renovation plan and repositioning common

areas with strategic upgrades.”

Built in 1971 on nearly 14 acres, the 13-building asset is

located on the border between Los Angeles County and Ventura County

at 603 Hampshire Road in Westlake Village. IMT Westlake Village

features two swimming pools with spas; tennis, basketball and

volleyball courts; an outdoor residential lounge, and a business

center. The area’s major employers include Amgen, Dole Food Co.,

Kythera Biopharmaceuticals, General Dynamics Corp., J.D. Power

& Associates, Teledyne Technologies Inc., Verizon, and

Volkswagen.

About Marcus & Millichap (NYSE: MMI)

With over 1,600 investment sales and financing professionals

located throughout the United States and Canada, Marcus &

Millichap is a leading specialist in commercial real estate

investment sales, financing, research and advisory services.

Founded in 1971, the firm closed over 8,700 transactions in 2015

with a value of approximately $37.8 billion. The company has

perfected a powerful system for marketing properties that combines

investment specialization, local market expertise, the industry’s

most comprehensive research, state-of-the-art technology, and

relationships with the largest pool of qualified investors. To

learn more, please visit: www.MarcusMillichap.com

About Institutional Property Advisors

With a network of senior-level investment advisors located

throughout the United States, Institutional Property Advisors (IPA)

is qualified to meet the needs of institutional and major private

investors. IPA’s combination of real estate investment and capital

markets expertise, industry-leading technology, superior support

services and acclaimed research offer customized solutions for the

acquisition and disposition of institutional properties and

portfolios. www.IPAusa.com

Marcus & Millichap Capital Corporation (MMCC) is a

subsidiary of Marcus & Millichap (NYSE: MMI), a leading

commercial real estate investment services firm with offices

throughout the United States and Canada. Through its network of

national, regional and local lenders, MMCC provides capital markets

products for a wide variety of investment properties, including

apartments, shopping centers, office buildings, industrial

facilities, single-tenant net-lease properties, seniors housing,

hotels/motels, manufactured home communities and self-storage

facilities. In 2015, MMCC closed more than 1,600 commercial real

estate financing transactions. To learn more, please visit:

www.mmCapCorp.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160830006359/en/

Marcus & MillichapGina Relva, 925-953-1716Public Relations

Manager

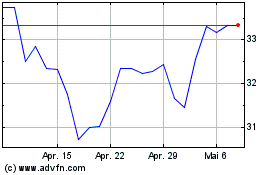

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

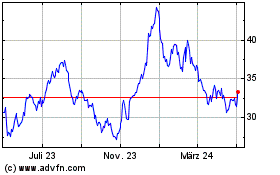

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024