BHP Billiton Withholds Bonus of CEO Andrew Mackenzie -- 2nd Update

30 August 2016 - 8:37PM

Dow Jones News

By Alex MacDonald

LONDON -- BHP Billiton Ltd.'s board has scrapped Chief Executive

Andrew Mackenzie's bonus after a mining-dam failure in Brazil

killed 19 people and contributed to the company's worst annual loss

ever, the company said Tuesday.

The bonuses of other senior BHP executives also will be cut by

varying amounts, said a spokesman for the world's largest mining

company by market value. The spokesman said Mr. Mackenzie won't be

paid his short-term incentive bonus for the year ended June 30 but

didn't specify whether Mr. Mackenzie's other benefits such as his

pension would be affected.

The details of senior management's compensation package will be

unveiled in full when BHP's annual report is published in a couple

of weeks time.

Mr. Mackenzie earned a salary of $1.7 million last year, an

amount that has been frozen since he took over as CEO in 2013. Last

year BHP paid $2.3 million to Mr. Mackenzie as a bonus, half in

cash and half in deferred shares due to vest in fiscal 2018.

The deadly dam burst on Nov. 5 ranks among Brazil's worst

environmental disasters, destroying villages and polluting more

than 400 miles of rivers. Brazilian federal prosecutors filed a

civil case against Vale, BHP Billiton and Samarco Mineração SA in

May calling for 155 billion reais ($48 billion) in damages,

comparing the fallout from Fundao's collapse to that of BP PLC's

Deepwater Horizon oil spill in 2010 in the Gulf of Mexico.

Mr. MacKenzie's bonus was scrapped after the company reported a

net loss of $6.39 billion for the 12 months through June. This

included $2.2 billion in impairments from the dam burst. The net

loss also includes $4.9 billion in impairments related to its U.S.

oil and gas business and slumping commodity prices.

"Having considered all these elements holistically, the board

and committee determined that the [bonus] outcome for the CEO for

FY2016 should be zero," said a company spokesman.

BHP said the decision is in keeping with Mr. Mackenzie's own

recommendation and follows similar action taken by the board in

previous years.

Executive compensation has been in the crosshairs at resources

companies after two years of slumping commodity prices and

shriveled profits.

At British oil giant BP PLC, shareholders in April rejected a

roughly 20% increase in the compensation package of Chief Executive

Bob Dudley for 2015, a period during which the company lost $5.2

billion. That vote was nonbinding.

Royal Dutch Shell PLC Chief Executive Ben van Beurden took an 8%

pay cut in 2015, with his direct compensation dropping to $5.61

million.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

August 30, 2016 14:22 ET (18:22 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

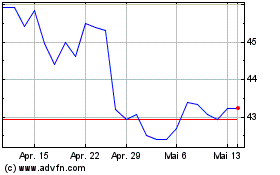

BHP (ASX:BHP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

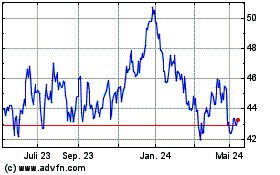

BHP (ASX:BHP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024