Euro Muted After ECB Stays Pat On Interest Rates

21 Juli 2016 - 10:14AM

RTTF2

The euro showed muted trading against its major currencies in

European deals on Thursday, after the European Central Bank left

its key interest rates unchanged, as policymakers wait for more

data to assess the impact of the Brexit on the Eurozone.

The 25-member Governing Council, led by ECB President Mario

Draghi, left the benchmark interest rate - the refi, unchanged at a

record low zero percent, after the policy session in Frankfurt.

The deposit rate was kept steady at -0.40 percent and the

marginal lending facility rate was maintained at 0.25 percent.

The Governing Council continues to expect the key ECB interest

rates to remain at present or lower levels for an extended period

of time, and well past the horizon of the net asset purchases, the

bank said in a statement.

Further, the bank confirmed that the monthly asset purchases of

EUR 80 billion are intended to run until the end of March 2017, or

beyond, if necessary, and in any case until it sees a sustained

adjustment in the path of inflation consistent with its inflation

aim.

Draghi is widely expected to signal more stimulus during his

post-decision press conference set to begin at 8.30 am ET.

The euro showed mixed trading against its major opponents in

Asian deals. While the euro rose against the greenback and the yen,

it declined against the pound. Against the franc, it held

steady.

The single currency that reversed from an early 2-day high of

1.1047 against the greenback held steady thereafter. The pair was

valued at 1.1013 when it closed yesterday's deals.

After climbing to near a 4-week high of 118.46 against the yen

in the previous session, the euro declined to a 6-day low of 116.14

and traded steadily afterwards. At yesterday's close, the pair was

worth 117.71.

Data from the Ministry of Economy, Trade and Industry reported

that Japan's all industry activity dropped for the first time in

three months in May.

The all industry activity index slid 1 percent month-on-month in

May, reversing a 0.8 percent rise in April. This was the first

increase in three months but slightly slower than the expected drop

of 1.1 percent.

The common currency eased back from an early 6-day high of

1.0904 against the Swiss franc, with the pair trading around

1.0877. On the downside, 1.075 is likely seen as the next support

level for the euro-franc pair.

Data from the Federal Customs Administration showed that

Switzerland's trade surplus declined in June.

The trade surplus fell to CHF 3.5 billion from CHF 3.8 billion

in May.

The euro showed a brief recovery to 0.8382 against the pound at

4:35 am ET, from an early 6-day low of 0.8302, and held steady

since then. The euro was trading at 0.8333 versus the pound at

Wednesday's close.

Data from the Office for National Statistics showed that British

retail sales declined more than expected in June.

Retail sales volume including auto fuel fell 0.9 percent

month-on-month in June, offsetting a 0.9 percent rise in May. This

was the biggest fall seen so far this year and larger than the

expected fall of 0.6 percent.

Looking ahead, Canada wholesale sales data for May, U.S. weekly

jobless claims for the week ended July 16, U.S. FHFA house price

index for May, U.S. existing home sales data for June, leading

indicator for June and Philadelphia Fed manufacturing index for

July are set to be published in the New York session.

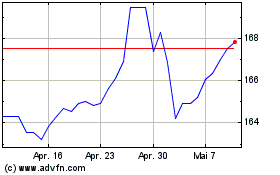

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

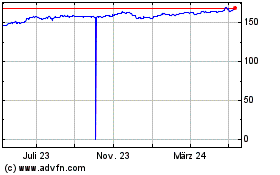

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024