Commodity Currencies Fall As Oil Prices Slide

19 Juli 2016 - 3:47AM

RTTF2

Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars weakened against the other major currencies in

the Asian session on Tuesday, as crude oil prices fell amid

persistent oversupply worries.

Crude oil for September delivery are currently down $0.21 at

$45.73 a barrel.

Traders await the release of energy inventory reports from the

API and EIA due today and tomorrow respectively.

The minutes of the Reserve Bank of Australia' monthly board

meeting released earlier in the day also weighed on the

currencies.

The minutes from the bank's July 5 meeting showed that the

members of the Reserve Bank of Australia's monetary policy board

said that a strengthening Australian dollar could cause problems

for the country's economic rebalancing. The country is still

recovering from the major drop in commodity prices, the bank

added.

At the meeting, the RBA board retained its record low interest

rate of 1.75 percent for the second straight month.

Meanwhile, traders bet on the prospects of a rate cut by the RBA

and RBNZ at their respective August meeting.

Monday, the Australian dollar held steady against its major

rivals.

The New Zealand and the Canadian dollars showed mixed

performance against their major rivals. While the kiwi and the

loonie fell against the U.S. dollar and the euro, they held steady

against the yen.

In the Asian trading, the Australian dollar fell to near 2-week

lows of 0.7509 against the U.S. dollar, 1.4738 against euro and

against the Canadian dollar, from yesterday's closing quotes of

0.7590, 1.4586 and 0.9824, respectively. If the aussie extends its

downtrend, it is likely to find support around 0.73 against the

greenback, 1.51 against the euro and 0.96 against the loonie.

Against the yen, the aussie dropped to a 4-day low of 79.38 from

yesterday's closing value of 80.57. On the downside, 74.00 is seen

as the next support level for the aussie.

The aussie edged down to 1.0690 against the NZ dollar, from an

early near 2-month high of 1.0771. The aussie may test support near

the 1.03 area.

The NZ dollar fell to near 2-month lows of 1.5772 against the

euro and 0.7013 against the U.S. dollar, from yesterday's closing

quotes of 1.5559 and 0.7115, respectively. If the kiwi extends its

downtrend, it is likely to find support around 1.63 against the

euro and 0.69 against the greenback.

Against the yen, the kiwi dropped to a 1-week low of 74.20 from

yesterday's closing value of 75.52. On the downside, 71.00 is seen

as the next support level for the kiwi.

The Canadian dollar fell to 1.2995 against the U.S. dollar and

81.34 against the yen, from yesterday's closing quotes of 1.2943

and 81.99, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.31 against the greenback and 78.00

against the yen.

Against the euro, the loonie dropped to 1.4386 against the euro

from yesterday's closing value of 1.4335. The loonie may test

support near the 1.46 area.

Looking ahead, U.K. consumer price, producer price and retail

price indexes for June and house price index for May and German ZEW

economic sentiment index for July are due to be released later in

the day.

New Zealand GDT diary auction is due to be held at 8:00 am

ET

In the New York session, U.S. building permits and housing

starts, both for June, are slated for release.

At 10:05 am ET, Bank of England Deputy Governor Ben Broadbent

will testify on blockchain technology before the Economic Affairs

Committee in London.

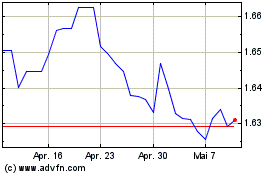

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Apr 2023 bis Apr 2024