Alibaba Under Fire From Global Product Brands Over Counterfeits

15 Juni 2016 - 6:07PM

Dow Jones News

By Kathy Chu

Alibaba Group Holding Ltd. is coming under fire from global

brands for rampant counterfeits on its shopping platforms, after

co-founder Jack Ma cast the Chinese e-commerce giant as the global

leader in the battle against fake goods.

Alibaba is the "world's leading fighter on counterfeits," Mr. Ma

said at an investor conference on Tuesday, noting that the company

has technology to track down sellers and buyers of counterfeits on

its platforms. "We can solve the (fake) problem better than any

government, any organization, any person in the world."

Mr. Ma said that part of the problem is that counterfeiters are

increasingly taking to the internet to distribute their fake goods,

which can be "better quality" and offer cheaper prices than

authentic branded goods.

The remarks are rankling global brands, which complain that

counterfeit goods remain a significant problem on Alibaba's sites

despite years of promises by the e-commerce company to crack down

on sellers of infringing goods. NetNames, which tracks counterfeits

online for brands such as Inditex and Billabong, said on Wednesday

that generally the clients it represents estimate 20% to 80% of the

branded goods on Alibaba's biggest China marketplace Taobao are

fakes.

"For Jack Ma to say what he did requires both hubris and

chutzpah," said Bharat Dube, chief executive of Strategic IP

Information, which works with brands including L'Occitane en

Provence to remove counterfeits online. "What world is he living

in?"

Mr. Dube called Alibaba's efforts to address counterfeits thus

far "superficial," and said the e-commerce giant could do a much

better job of ferreting out fakes on its platforms.

Alibaba has said it would spare no expense in fighting

counterfeits. An Alibaba spokesman said the NetNames estimate of

fakes is a "wild, inaccurate guess made by a self-interested party.

There is no methodology to support a claim like this."

The latest controversy comes a month after a prominent

anticounterfeiting group, the International Anticounterfeiting

Coalition, suspended a newly created category under which Alibaba

was admitted as a member, following questions from brands about

Alibaba's sincerity in fighting fakes. Fashion brand Michael Kors,

in a letter to the IACC board, said that the group's admission of

Alibaba provides "cover to our most dangerous and damaging

adversary."

As Chinese authorities get ready to scrutinize fake goods

online, Alibaba Group has promised wholesale changes to how it

deals with infringing products, including shifting the burden of

proof to sellers on its platforms to show that their goods are

authentic.

Mr. Ma said that Alibaba has more than 2,000 people working to

rid its platforms of counterfeit goods, but the substantial size of

the platforms makes the task challenging. In the fiscal year ended

March 31, Alibaba's China marketplaces handled $485 billion in

merchandise volume, which analysts estimate is more than e-commerce

sites Amazon.com and eBay combined.

"Brands are frustrated that Jack Ma and others are standing up

and saying that they're investing all this money, but they don't

see an impact," said Haydn Simpson, commercial director at

NetNames, the counterfeit tracker.

Some analysts also question how much of Alibaba's volume comes

from fake-goods sales or fake transactions, which involve sellers

paying people to place fictitious orders to boost their standing on

Alibaba's site. The concern is that such questionable transactions

could drive customer traffic that in turn could profit Alibaba.

Alibaba has said that it uses sophisticated tools to identify

and exclude fake transactions. Mr. Ma, at the investors'

conference, also said the company's business could be hurt rather

than helped by fake-goods sales. "Every fake product we sell, we

are losing five customers," he said. "We are the victims of that."

He didn't explain his reasoning for that statement.

--Eva Dou contributed to this article

(END) Dow Jones Newswires

June 15, 2016 11:52 ET (15:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

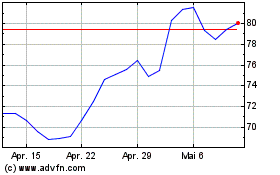

Alibaba (NYSE:BABA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

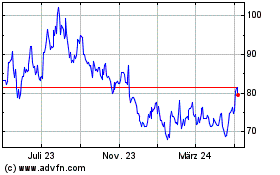

Alibaba (NYSE:BABA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024