Canadian Dollar Drops On Weaker Oil Prices

02 Mai 2016 - 7:53AM

RTTF2

The Canadian dollar lost ground against the other major

currencies in early European trading on Monday, following a decline

in oil prices on increased oil production in Iraq in April, adding

to signs over supply glut in market.

Crude for June delivery fell $0.32 to $45.60 per barrel.

Iraqi exports rose to 3.36 million barrels a day in April, from

March's 3.29 million barrels a day, which were near the record

3.365 million in November, Oil Ministry spokesman Asim Jihad said

on Sunday.

Data released over the weekend showed that China's manufacturing

and service sector activities expanded less than the previous month

in April. Even though the data reinforced signs of a tepid economic

recovery, it raised doubts about the effect of recent stimulus

measures.

European stocks are mixed, with trading thin amid public

holidays in Greece, Ireland, Russia and the U.K.

The loonie showed mixed performance in Asian deals. While the

loonie held steady against the greenback, euro and the aussie, it

declined against the yen.

The loonie weakened to 0.9563 against the aussie, off its early

near 6-month high of 0.9524. The next possible support for the

loonie may be seen around the 0.97 zone.

The latest survey from National Australia Bank showed that

Australia's business confidence ebbed in April, with an index score

of +5.

That's down from +6 in March.

Reversing from an early high of 1.2529 against the greenback,

the loonie edged down to 1.2559. The loonie is seen finding support

around the 1.28 mark.

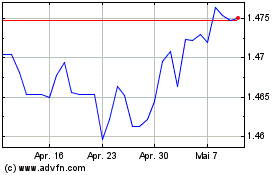

The loonie declined to 1.4415 against the euro, its weakest

since April 21. This is lower by 0.3 percent from last week's

closing value of 1.4367. If the loonie slides further, 1.46 is

likely seen as the next support level.

Final data from Markit showed that Eurozone manufacturing growth

improved marginally in April.

The factory Purchasing Managers' Index rose to 51.7 in April

from 51.6 in March and above the flash score of 51.5. It was also

over the long-run survey average of 51.4.

The loonie eased back to 84.70 against the yen, heading to

pierce its early 2-week low of 84.52. The loonie is likely to

challenge support around the 82.00 mark.

Looking ahead, U.S. manufacturing PMI reports for April and

construction spending for March are due in the New York

session.

At 10:00 am ET, the European Central Bank President Mario Draghi

speaks at the Asian Development Bank's 49th Annual Meeting, in

Frankfurt.

The Swiss National Bank Chairman Thomas Jordan will deliver a

speech about the euro and Swiss monetary policy at the Europa Forum

in Luzern at 12:30 pm ET.

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Apr 2023 bis Apr 2024