Loonie Mixed After Canada GDP Report

29 April 2016 - 11:43AM

RTTF2

The Canadian dollar traded mixed against the other major

currencies in European deals on Friday, after data showed that the

Canadian economy shrank in February, led by declines in activity of

goods producing industries.

Data from Statistics Canada showed that Canadian economy

contracted 0.1 percent in February after expanding 0.6 percent in

January. Economists were looking for a 0.2 percent fall.

Separate data showed industrial product price index dropped 0.6

percent on month in March, contradicting expectations for an

increase of 0.5 percent. In February, the index fell 1.1

percent.

Crude oil prices rallied on the back of a weaker dollar and on

hopes that dwindling U.S. oil production would help balance an

oversupplied market.

The loonie was lower against most major rivals in Asian deals,

amid rising risk aversion, following the sell-off on Wall Street

overnight and as the Bank of Japan shocked financial markets by

keeping its monetary policy steady despite multiple headwinds

plaguing the economy.

In European deals, the loonie wobbled against the yen with the

pair trading at 85.49, following a 10-day low of 85.38 hit at 4:20

am ET. The pair was worth 86.08 when it finished Thursday's

trading.

Reversing from an early 10-month high of 1.2500 against the

greenback, the loonie fell back to 1.2541. The loonie may locate

support around the 1.27 region.

Data from the U.S. Commerce Department showed a slightly bigger

than expected increase in personal income in March, while the

personal spending rose less than expected.

The report said personal income climbed by 0.4 percent in March

after inching up by a downwardly revised 0.1 percent in

February.

Economists had been expecting income to rise by 0.3 percent

compared to the 0.2 percent increase originally reported for the

previous month.

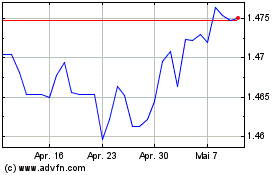

The loonie weakened to a 2-day low of 1.4319 against the euro,

off its prior high of 1.4230. Continuation of the loonie's

downtrend may lead it to a support around the 1.46 mark.

Preliminary data from Eurostat showed that the euro area

economic growth accelerated more than expected in the first

quarter.

Gross domestic product climbed 0.6 percent from prior quarter,

following a 0.3 percent rise in the fourth quarter. Economists had

forecast the growth rate to improve marginally to 0.4 percent.

The loonie held steady against the aussie, after having advanced

to 0.9543 at 6:45 am ET. At yesterday's close, the pair was worth

0.9567.

Looking ahead, U.S. Chicago PMI for April and the University of

Michigan's final U.S. consumer sentiment index for April are set to

be published in the New York session.

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Apr 2023 bis Apr 2024