U.S. Dollar Weakens Ahead Of U.S. GDP Data

28 April 2016 - 10:07AM

RTTF2

The U.S. dollar slipped against its key counterparts in European

trading on Thursday, as traders await U.S. GDP data due today,

which is expected to show a slowdown in economic activity for the

first quarter.

The Commerce Department is due to release advance estimate of

first quarter GDP at 8:30 am ET. Economists expect a slowdown in

growth to 0.7 percent.

At the same time, the Labor Department is scheduled to release

its jobless claims report for the week ended April 23rd. The

consensus estimate calls for an increase in claims to 260,000 from

247,000.

The Federal Reserve kept its benchmark interest rate unchanged

on the back of disappointing recent economic data at the end of

two-day meeting ending Wednesday.

The Fed offered a somewhat more optimistic view of the global

economy and downplayed recent weakness in the U.S. economy, but

didn't signal that a rate increase could come as soon as June.

Meanwhile, European stocks fell sharply on Thursday after the

Bank of Japan surprised market participants by holding back from

further stimulus.

Financial markets rattled as the central bank policy inaction

comes despite deterioration in Japan's economic fundamentals.

The dollar has been trading in a negative territory against its

major rivals in Asian trading, as the Fed signaled that it would

raise rates at a slower pace.

The greenback fell to a 10-day low of 107.92 against the yen,

from an early 3-day high of 111.88. The greenback is seen finding

support around the 105.00 zone.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's retail sales decreased at a slower-than-expected pace

in March.

Retail sales fell 1.1 percent year-over-year in March, slower

than the 1.4 percent decrease expected by economists. In February,

sales had risen 0.4 percent.

The greenback slipped to 1.4619 against the pound and 0.7657

against the aussie, from early highs of 1.4523 and 0.7572,

respectively. The next possible support levels for the greenback

may be found around 1.47 against the pound and 0.78 against the

aussie.

The greenback dropped to 1-week lows of 1.1368 against the euro

and 0.9657 versus the franc, reversing from its previous highs of

1.1296 and 0.9733, respectively. Continuation of the greenback's

downtrend may take it to support levels of around 1.15 against the

euro and 0.95 against the franc.

The greenback slid to an 8-day low of 0.6990 against the NZ

dollar and nearly a 10-month low of 1.2528 versus the loonie, off

its prior highs of 0.6823 and 1.2606, respectively. If the

greenback falls further, it may challenge support around 0.72

against the kiwi and 1.24 against the loonie.

Looking ahead, German preliminary CPI for April is due

shortly.

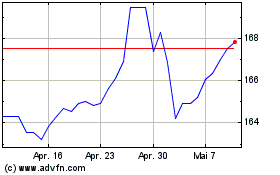

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

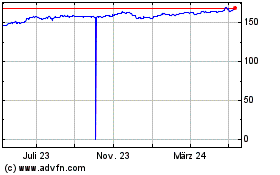

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024