Riksbank Lifts QE, Holds Negative Rate

21 April 2016 - 7:57AM

RTTF2

Sweden's central bank expanded its asset purchase programme and

kept its negative interest rate unchanged to take on the risk of

currency appreciation and cool inflation.

The Executive Board of the Riksbank decided to expand the

quantitative easing by SEK 45 billion during the second half of

2016, so that the purchases will total SEK 245 billion at the end

of 2016.

Deputy Governor Cecilia Skingsley preferred to keep bond

purchases unchanged at the April meeting.

"With continued expansionary monetary policy abroad, there is a

risk that the krona will appreciate earlier and faster than in the

forecast," the bank said. "This could dampen growth and inflation

in Sweden and affect confidence in the inflation target."

Although inflation is rising, it is expected to undershoot the

target in 2016, the bank noted.

Riksbank also maintained the repo rate at -0.50 percent. The

bank said that the rate will start to be raised slowly in the

middle of 2017, when CPIF inflation is expected to be close to 2

percent.

The bank had lowered the rate by 0.15 percentage points at its

prior meeting in February.

There is still a high level of preparedness to make monetary

policy even more expansionary if this is needed to safeguard the

inflation target, the bank said today.

Inflation had doubled to 0.8 percent in March from 0.4 percent

in February. The bank expects inflation to rise to 1 percent this

year, instead of 0.7 percent projected in February. Meanwhile, the

forecast for 2017 was downgraded to 1.9 percent from 2.1

percent.

The bank upgraded its GDP outlook for 2016 to 3.7 percent from

3.5 percent, while lowering the projection for 2017 to 2.7 percent

from 2.8 percent.

In an extra session in January, the board awarded Governor

Stefan Ingves, and the First Deputy Governor Kerstin af Jochnick,

powers to "instantly intervene" in the foreign exchange market when

necessary.

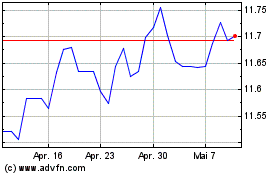

Euro vs SEK (FX:EURSEK)

Forex Chart

Von Mär 2024 bis Apr 2024

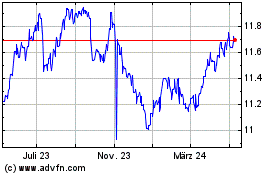

Euro vs SEK (FX:EURSEK)

Forex Chart

Von Apr 2023 bis Apr 2024