Current Report Filing (8-k)

30 März 2016 - 12:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

March 24, 2016

Date

of report (date of earliest event reported)

Surgery

Partners, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37576

|

|

47-3620923

|

|

(State or other jurisdictions of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Nos.)

|

40 Burton Hills Boulevard, Suite 500

Nashville, Tennessee 37215

(Address of principal executive offices) (Zip Code)

(615) 234-5900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the

following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On March 24, 2016, SP Holdco I, Inc.

and Surgery Center Holdings, Inc. (each an indirectly wholly-owned subsidiary of Surgery Partners, Inc.) along with certain other indirectly wholly-owned entities (the “Guarantors,” and together with SP Holdco I, Inc. and Surgery Center

Holdings, Inc., the “Subsidiaries”) that each guarantee the First Lien Credit Agreement (as defined herein) entered into an amendment (the “Incremental Term Loan Amendment”) to the First Lien Credit Agreement, dated as of

November 3, 2014 (as amended, the “First Lien Credit Agreement”), by and among the Subsidiaries, the Incremental Lenders, Jefferies Finance LLC, as the Administrative Agent and the Collateral Agent thereunder, and Jefferies Finance

LLC, as Issuing Bank (as amended, restated, amended and restated, supplemented or otherwise modified from time to time). The Incremental Term Loan Amendment amends the First Lien Credit Agreement to increase certain lenders’ commitments to

Surgery Center Holdings, Inc. and enables Surgery Center Holdings, Inc. to obtain an incremental term loan in an aggregate principal amount of $80 million pursuant to the terms of the First Lien Credit Agreement and the Incremental Term Loan

Amendment. Capitalized terms used in this description but not defined herein have the meanings given to them in the First Lien Credit Agreement, as amended by the Incremental Term Loan Amendment. A copy of the Incremental Term Loan Amendment is

attached as Exhibit 10.1 to this Current Report on Form 8-K.

On March 28, 2016, Surgery Center Holdings, Inc. (the

“Issuer”), entered into a purchase agreement with the representatives of certain initial purchasers, relating to the issuance and sale of $400 million in gross proceeds of the Issuer’s 8.875% senior unsecured notes due 2021. The net

proceeds from the notes offering will be used to repay the borrowings outstanding under the Issuer’s senior secured second lien credit facility, to repay the outstanding balance on its revolving credit facility, to pay fees and expenses

associated with the notes offering and for general corporate purposes. The consummation of the notes offering is subject to market and other conditions.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in the first paragraph of Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

On March 29, 2016, Surgery Partners, Inc. issued a press release

announcing the pricing of the notes offering. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

First Lien Incremental Term Loan Amendment and Consent, dated as of March 24, 2016, by and among SP Holdco I, Inc., Surgery Center Holdings, Inc., Jefferies Finance LLC and the other guarantors and lenders party thereto

|

|

|

|

|

99.1

|

|

Press release dated March 29, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Surgery Partners, Inc.

|

|

|

|

|

By:

|

|

/s/ Michael T. Doyle

|

|

|

|

Michael T. Doyle

Chief Executive

Officer

|

Date: March 29, 2016

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

First Lien Incremental Term Loan Amendment and Consent, dated as of March 24, 2016, by and among SP Holdco I, Inc., Surgery Center Holdings, Inc., Jefferies Finance LLC and the other guarantors and lenders party thereto

|

|

|

|

|

99.1

|

|

Press release dated March 29, 2016

|

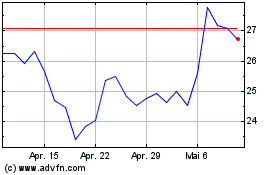

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

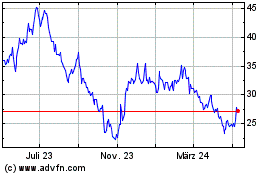

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024