Dollar Mostly Lower In Lackluster Trading Session

02 Februar 2016 - 3:17PM

RTTF2

The dollar is down slightly against both the Euro and the

Japanese Yen Tuesday afternoon, but is nearly unchanged in

comparison to the British pound. There has been no U.S. economic

data to drive the direction of trading today. Meanwhile,

unemployment data in the Eurozone came in better than

anticipated.

Investors can look forward to the release of the U.S. employment

report for January at the end of the week. Ahead of the highly

anticipated jobs report, private sector employment is due to be

released tomorrow, while weekly jobless claims are scheduled for

Thursday. Readings on the ISM non-manufacturing index and factory

orders are also due out in the next few days.

The dollar slipped to a low of $1.0939 against the Euro Tuesday,

but has since bounced back to around $1.0920.

The euro area unemployment rate reached its lowest level in more

than four years in December, but it remained at an elevated level

as rates stayed stubbornly high in Greece and Spain.

The jobless rate dropped to 10.4 percent in December from 10.5

percent in November, Eurostat reported Tuesday. This was the lowest

since September 2011. The rate was expected to remain unchanged at

10.5 percent. A year ago, the unemployment rate was 11.4

percent.

Eurozone producer prices continued its downward trend in

December, Eurostat reported Tuesday. Producer prices dropped by a

more-than-expected 3 percent but slower than the 3.2 percent

decrease seen each in previous three months. Economists had

forecast a 2.8 percent fall for December.

German unemployment declined more than expected in January, the

Federal Labor Agency reportedly said Tuesday. The number of people

out of work decreased 20,000, much bigger than an expected decrease

of 8,000.

The jobless rate fell to a record 6.2 percent from 6.3 percent

in December. It was forecast to remain unchanged at 6.3 percent in

January.

Germany's ILO unemployment rate dropped slightly in December

after rising in the previous two months, while employment increased

from a year ago, provisional data from Destatis showed Tuesday. The

unadjusted jobless rate fell to 4.5 percent from 4.6 percent in

November. In October, the figure was 4.4 percent. The December

unemployment rate remained unchanged from the same month last

year.

The buck reached an early high of $1.4325 against the pound

sterling Tuesday, but has since eased back to around $1.4420,

nearly flat on the session.

British construction sector expanded at the weakest pace in nine

months in January, survey results from Markit showed Tuesday. The

Chartered Institute of Procurement & Supply/Markit Purchasing

Managers' Index fell to 55.0 in January from 57.8 in December.

However, any reading above 50 indicates expansion in the sector.

It was forecast to drop slightly to 57.6.

The greenback has slipped to around Y120.085 against the

Japanese Yen this afternoon, from last Friday's high of around

Y121.500.

The Yen is benefitting from its safe haven status as another

drop in crude oil prices has investors fleeing the risk of the

equity markets.

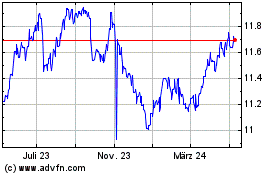

Euro vs SEK (FX:EURSEK)

Forex Chart

Von Mär 2024 bis Apr 2024

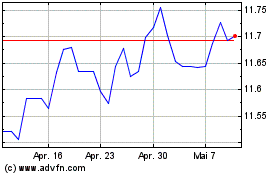

Euro vs SEK (FX:EURSEK)

Forex Chart

Von Apr 2023 bis Apr 2024