Loonie Climbs As Oil Prices Rose After Iran Hints At OPEC Talks

10 Februar 2016 - 9:12AM

RTTF2

The Canadian dollar advanced against its most major rivals in

European deals on Wednesday, as oil prices rallied after Iran

signaled that it is ready for cooperation with OPEC nations to

resolve the problem of global oversupply of oil.

"We support any form of dialogue and cooperation with OPEC

member states, including Saudi Arabia," Iran's Oil Minister Bijan

Zangeneh told Iran's Press TV.

Russia's largest oil producer Rosneft blamed the OPEC for lack

of coordination among members to address the situation of excess

oil supply existing in the market.

Rosneft's CEO Igor Sechin suggested that coordinated cuts by all

producers by one million barrels per day would significantly

support prices.

Traders await the Energy Information Administration's weekly

inventory data due today, following yesterday's API data that

showed a build of 2.4 million barrels in U.S. crude

inventories.

Focus also shift towards semi-annual testimony from the Federal

Reserve Chair Janet Yellen later today, which could shed more light

on the Fed's policy outlook.

Deteriorating global outlook and volatility in financial markets

since December have arose speculation that Yellen may concede about

her change in plan to hike rate four times this year.

The loonie declined against most major rivals in Asian deals, as

worries about global economic growth continued to weigh on investor

sentiment.

In European deals, the loonie bounced off to 83.19 against the

yen, reversing from a low of 82.11 hit at 11:30 pm ET. The next

possible resistance for the loonie-yen pair is seen around the

84.00 zone.

Data from the Bank of Japan showed that Japan's producer prices

fell 0.9 percent on month in January.

That missed forecasts for a decline of 0.7 percent following the

0.4 percent contraction in December.

The loonie rose to 1.3820 against the greenback and 1.5564

against the euro, from its early low of 1.3921 and near 3-week low

of 1.5726, respectively. If the loonie extends rise, it may

challenge resistance around 1.37 against the greenback and 1.55

against the euro.

On the flip side, the loonie declined to 0.9869 against the

aussie, and held steady thereafter. The pair was valued at 0.9797

when it ended Tuesday's trading.

Looking ahead, the NIESR U.K. GDP estimate for January and U.S.

Federal budget statement for January are due to be released in the

New York session.

At 9:00 am ET, European Central Bank Board member Peter Praet

will deliver keynote speech at the "Lender of Last Resort: An

International perspective" conference organized by Harvard

University in Washington.

At 1:30 pm ET, Federal Reserve Bank of San Francisco President

John Williams is scheduled to speak before the 2016 National

Interagency Community Reinvestment Conference, "Pathways to

Economic Opportunity," in Los Angeles.

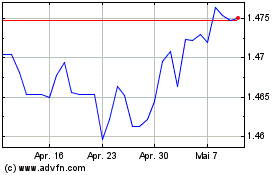

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Apr 2023 bis Apr 2024