Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Friday amid rising risk aversion, as investors

turned cautious ahead of the release of the U.S. Labor Department's

closely-watched monthly jobs report due later in the day.

The monthly jobs data could have a significant impact on the

outlook for whether the U.S. Federal Reserve will raise interest

rates at its meeting later this month.

Economists expect the monthly jobs report to show an increase of

about 220,000 jobs in August following the addition of 215,000 jobs

in July. The unemployment rate is expected to dip to 5.2 percent

from 5.3 percent.

Meanwhile, oil prices dipped as investors remain cautious ahead

of U.S. jobs data later in the day which is expected to provide

clues on the timing of Federal Reserve's decision on rate hike.

The U.S. oil rig data due later today is also awaited. Any drop

in rig numbers is likely to bolster the commodity.

Also, the weekly crude stockpiles report from the Energy

Information Administration released Wednesday showed that crude

stockpiles in the U.S. increased 4.7 million barrels in the week

ended August 28, more than the increase expected by analysts.

Crude oil for October delivery are currently down $0.19 at

$46.56 a barrel.

Moreover, some economists expect the RBNZ to cut its official

cash rate by at least 25 basis points at its forthcoming meet on

September 10th and a further cut in the fourth quarter. The plunge

in Global dairy prices, weaker than expected GDP growth and fall in

core inflation, has triggered expectations for a rate cut.

The markets in China remain closed on Friday for the Victory Day

holiday. They will re-open on Monday.

Thursday, the Australian, the New Zealand and the Canadian

dollar rose against their major rivals after European Central Bank

president Mario Draghi said he is ready to pump more stimulus to

jump-start the Eurozone economy. Meanwhile, the European Central

Bank left interest rates unchanged.

The Australian dollar rose 0.19 percent against the U.S. dollar,

0.43 percent against the yen and 0.63 percent against the euro. The

NZ dollar rose 0.72 percent against the U.S. dollar, 0.60 percent

against the yen and 1.71 percent against the euro. The Canadian

dollar rose 0.66 percent against the U.S. dollar, 0.34 percent

against the yen and 1.68 percent against the euro.

In the Asian trading, the Australian dollar fell to nearly a

6-1/2-year low of 0.6961 against the U.S. dollar and a 2-year low

of 0.9198 against the Canadian dollar, from yesterday's closing

quotes of 0.7017 and 0.9245, respectively. If the aussie extends

its downtrend, it is likely to find support around 0.62 against the

greenback and 0.90 against the loonie.

Against the yen and the NZ dollar, the aussie dropped to nearly

a 2-week low of 83.05 and a 9-day low of 1.094 from yesterday's

closing quotes of 84.25 and 1.0965, respectively. The aussie may

test support near 81.00 against the yen and 1.07 against the

kiwi.

The aussie edged down to 1.5991 against the euro, from

yesterday's closing value of 1.5845. On the downside, 1.65 is seen

as the next support level for the aussie.

The NZ dollar fell to a 2-day low of 75.83 against the yen, from

yesterday's closing value of 76.82. On the downside, 72.00 is seen

as the next support level for the kiwi.

Against the U.S. dollar and the euro, the kiwi dropped to 0.6356

and 1.7512 from yesterday's closing quotes of 0.6397 and 1.7372,

respectively. If the kiwi extends its downtrend, it is likely to

find support 0.61 against the greenback and 1.85 against the

euro.

The Canadian dollar fell to 1.3221 against the U.S. dollar and

90.23 against the yen, from yesterday's closing quotes of 1.3178

and 91.09, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.33 against the greenback and 87.00

against the yen.

Against the euro, the loonie edged down to 1.4714 from

yesterday's closing value of 1.4644. The loonie may test support

near the 1.54 region.

Meanwhile, the safe-haven currencies such as the yen and the

Swiss franc rose against its major rivals.

The yen rose to a 4-month high of 132.77 against the euro and

nearly a 4-month high of 181.77 against the pound from yesterday's

closing quotes of 133.54 and 183.07, respectively. If the yen

extends its uptrend, it is likely to find resistance around 130.00

against the euro and 178.00 against the pound.

Data from the Ministry of Health, Labor and Welfare showed that

Japan's base wages increased at the fastest pace in almost ten

years in July. Regular pay grew 0.6 percent in July from last year,

the biggest since November 2005. This was the fifth consecutive

rise in base pay.

Against the U.S. dollar, the yen advanced to a 2-day high of

119.29 from yesterday's closing value of 120.06. The yen may test

resistance near the 115.00 region.

Against the Swiss franc, the yen edged up to 122.79 from

yesterday's closing value of 123.33. On the upside, 121.00 is seen

as the next resistance level for the yen.

The Swiss franc rose to a 4-day high of 1.0804 against the euro,

from yesterday's closing value of 1.0827. The franc may test

resistance near the 1.06 region.

Against the pound and the U.S. dollar, the franc edged up to

1.4794 and 0.9709 from yesterday's closing quotes of 1.4848 and

0.9733, respectively. If the Swiss franc extends its uptrend, it is

likely to find resistance around 1.45 against the pound and 0.95

against the greenback.

Looking ahead, German factory orders for July is due to be

released at 2:00 am ET.

Swiss CPI and Germany's construction PMI, both for August are

also slated for release in the European session.

In the New York session, Canada unemployment data and Ivey's

PMI, U.S. non-farm payrolls report and unemployment data, all for

August, are set to be published.

At 8:10 am ET, Federal Reserve Bank of Richmond President

Jeffrey Lacker will deliver a speech titled "The Case Against

Further Delay" at the Retail Merchants Association in Richmond.

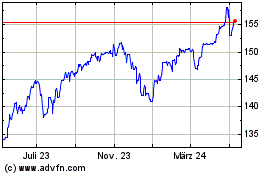

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

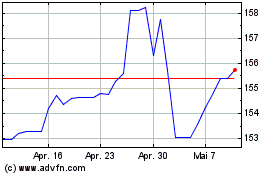

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024