ECB Holds Fire As Sluggish Eurozone Recovery Continues

03 September 2015 - 10:29AM

RTTF2

The European Central Bank left its interest rates unchanged on

Thursday as recent data suggest that economic recovery is

continuing, albeit at a sluggish pace, while lower oil prices,

stronger euro and the Chinese slowdown pose risks to the

outlook.

The Governing Council, led by ECB President Mario Draghi, kept

the refinancing rate at a record low 0.05 percent, following the

meeting in Frankfurt. The decision was in line with economists'

expectations.

The bank also left the deposit rate unchanged at -0.20 percent

and the marginal lending rate at 0.30 percent. The three main

interest rates were lowered by 10 basis points in September last

year.

Draghi will hold his customary post-decision press conference at

8.30 am ET, when he is set to unveil the latest ECB staff

macroeconomic forecasts. Inflation forecasts are widely expected to

be lowered. He is also expected to say that the eurozone is largely

immune to the recent Chinese financial market crisis.

In June, the inflation projection for this year was raised to

0.3 percent from zero, while forecasts for next year and 2017 were

maintained at 1.5 percent and 1.8 percent, respectively.

Growth projections for this year and next were retained at 1.5

and 1.9 percent, respectively. However, the prediction for 2017 was

lowered to 2 percent from 2.1 percent.

"The growth outlook is hardly strong and the concerns over China

and the appreciation of the euro present a serious external

threat," Capital Economics economist Jonathan Loynes said.

Inflation remained unchanged at a very low level of 0.2 percent

in August as further fall in oil prices curbed its ability to move

upward. The ECB aims to keep inflation 'below but close to 2

percent'.

Given the prospect of a renewed fall in inflation expectations,

the economist expects Draghi to insist again that the ECB's current

$1.1 trillion quantitative easing program will be implemented in

full.

Draghi may also give a further strong hint that that stimulus

might be extended or accelerated, or both, Loynes said. "He won't

say so, but part of the intention will no doubt be to weaken the

euro again," the economist added.

Eurozone economic growth slowed slightly to 0.3 percent in the

second quarter despite slight improvement in Germany, as France

came to a halt, restoring the divergence between the two largest

euro area economies.

In a report released Thursday, the International Monetary Fund

urged the European Central Bank to extend its quantitative easing

programme if there isn't sufficient improvement in inflation

consistent with meeting medium-term price stability objectives.

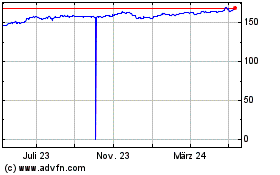

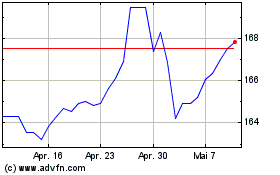

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024