Euro Muted Amid ECB Announcement

03 September 2015 - 10:23AM

RTTF2

Thursday, the euro showed little response to the European

Central Bank decision maintaining interest rates at record low as

expected, with investors focus to the press conference by the ECB

chief Mario Daghi for more indications about its stimulus programe

amid threats to global growth.

The Governing Council, led by ECB President Mario Draghi, kept

the refinancing rate at a record low 0.05 percent, following the

meeting in Frankfurt. The decision was in line with economists'

expectations.

The bank also left the deposit rate unchanged at -0.20 percent

and the marginal lending rate at 0.30 percent. The three main

interest rates were lowered by 10 basis points in September last

year.

Draghi will hold his customary post-decision press conference at

8.30 am ET, when he is set to unveil the latest ECB staff

macroeconomic forecasts. Inflation forecasts are widely expected to

be lowered.

The currency trended higher in early deals, after data showed

that the economic activity across the currency bloc gathered pace

in August

Final data from Markit showed that Eurozone private sector

growth improved more than estimated in August.

The final composite output index rose to 54.3 in August from

53.9 in July. The flash reading for August was 54.1.

Business activity improved at the fastest pace in over four

years. Levels of incoming new business also rose at a solid, albeit

slightly slower pace to support the second-quickest rate of job

creation since May 2011, the survey showed.

The euro showed mixed performance in the Asian session. While

the euro held steady against the yen, it was down against the

greenback, franc and the pound.

Although the euro rebounded from an early 3-day low of 1.1204

against the greenback, it failed to hold its gains in subsequent

deals. The pair was trading at 1.1235, compared to Wednesday's

closing value of 1.1223.

The euro held steady against the pound, after bouncing off from

an early 2-day low of 0.7322. The pair was valued at 0.7334 at

Wednesday's close.

Survey results from Markit Economics and the Chartered Institute

of Procurement & Supply showed that British services growth

unexpectedly slowed for second straight month in August to its

weakest rate in over two years as new business growth eased.

The Markit/CIPS services purchasing managers' index dropped to

55.6, which was the weakest score since May 2013.

The common currency traded steadily against the franc, following

an advance to a session's high of 1.0901 at 5:00 am ET. At

Wednesday's close, the pair traded at 1.0877.

The 19-nation currency remained lower against the Japanese yen,

with the pair trading at 135.04. Further weakness may take the euro

to a support around the 134.00 region.

Looking ahead, Canada and U.S. trade data for July, U.S. weekly

jobless claims for the week ended August 29 and U.S. ISM

non-manufacturing PMI for August are slated for release in the New

York session.

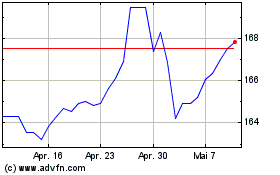

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

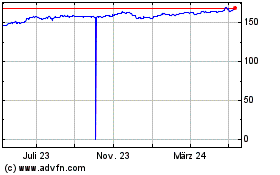

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024