Canadian Dollar Falls As Oil Prices Drop

01 Juli 2015 - 8:28AM

RTTF2

The Canadian dollar continued to be weaker against most major

currencies in the Asian session on Wednesday, as oil prices dropped

amid risk aversion after cash-strapped Greece became the only

developed country ever to fall into default missing a 1.6 billion

euro payment to the International Monetary Fund overnight.

Crude oil for August delivery are currently down $0.73 to $58.74

a barrel.

The Greek crisis worsened, with the debt laden nation missing

its EUR 1.6 billion loan payment to the International Monetary

Fund, as the Eurogroup earlier rejected any bailout extension in

spite of the European Central Bank's decision to hold a meeting to

review the emergency funding assistance.

In last minute efforts, the Greek government submitted a request

for a two-year bailout with the European Stability Mechanism (ESM)

to fully cover its financing needs, along with debt restructuring,

the state-backed ANA-MPA news agency reported citing a statement

from the office of the Prime Minister Alexis Tsipras.

The ECB is set to hold a Governing Council meeting on Wednesday

to review the emergency funding assistance to Greek banks. The

lender had refused to raise the cap of its emergency liquidity

assistance on Sunday as the Eurogroup rejected any bailout

extension a day earlier

The oil supply by the Organization of the Petroleum Exporting

Countries or OPEC was increased, due to higher output from Iraq and

Saudi Arabia.

The deadline on talks between Iran and the western powers on

Iran's nuclear program was extended by a week to July 7. An

agreement could have seen sanctions on Tehran withdrawn, enabling a

massive flow of Iranian oil into the global markets. This could

create a supply glut scenario and possibly bringing oil prices down

drastically.

The American Petroleum Institute said in a weekly report

released late Tuesday that U.S. crude stockpiles rose 1.9 million

barrels in the week to June 26. While, the markets expected a drop

of 2 million barrels.

The U.S. Energy Information Administration is set to release its

weekly oil report later in the day.

Sentiment towards the loonie was also dampened by the Canadian

GDP contracting for the fifth straight month.

Statistics Canada reported Tuesday that Canadian GDP for April

fell by 0.1 percent in April following the decline of 0.2 percent

in March. Economists expected an increase of 0.1 percent.

Tuesday, the Canadian dollar fell 0.70 percent against the U.S.

dollar, 0.77 percent against the yen, 0.01 percent against the euro

and 0.97 percent against the Australian dollar.

In the Asian trading now, the Canadian dollar fell to nearly a

4-week low of 1.2502 against the U.S. dollar, from yesterday's

closing value of 1.2487. The loonie may test support near the 1.27

region.

Against the euro and the yen, the loonie edged down to 1.3924

and 97.94 from yesterday's closing quotes of 1.3910 and 98.00,

respectively. If the loonie extends its downtrend, it is likely to

find support around 1.42 against the euro and 96.00 against the

yen.

Looking ahead, final June PMI reports for major European

economies are due to be released in the European session.

At 5:30 am ET, the Bank of England will publish the financial

stability report followed by Governor Mark Carney's news

conference, in London.

In the New York session, U.S. manufacturing PMI reports for

June, U.S. construction spending for May and weekly U.S. oil

inventories report are slated for release.

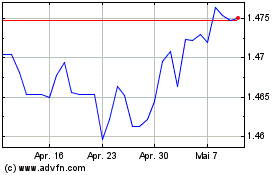

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Apr 2023 bis Apr 2024