Yen Extends Rise Amid Greek Woes

30 Juni 2015 - 7:37AM

RTTF2

The Japanese yen continued to be stronger against the other

major currencies in the Asian session on Tuesday, as the ongoing

worries about the looming threat of a Greek debt default and the

possibility of the debt-laden country exiting the eurozone have

increased the demand for the safe-haven currency.

Fears about the deepening Greek crisis have roiled global

markets.

Greece and its creditors have failed to reach an agreement on a

deal to release bailout funds in time for Greece to meet a 1.6

billion euro debt payment to the International Monetary Fund due

later this day.

Greek Prime Minister Alexis Tsipras reportedly said on Monday

that his country will not make the payment to the IMF by the

Tuesday deadline unless Greece strikes a deal with its

creditors.

The safe haven currency's gain came as the latest round of talks

between Greece and its creditors broke down over the weekend.

Tsipras subsequently called for a referendum on the bailout

proposals by creditors on July 5.

Meanwhile, the Japanese stock market rebounded, from a one-week

closing low in the previous session amid concerns about the impact

of the Greek crisis on the global economy. The benchmark Nikkei 225

Index is currently up 34.56 points or 0.17 percent at 20,144.

In other economic news, a preliminary report from the Ministry

of Health, Labor and Welfare showed that a the total labor cash

earnings in Japan rose 0.6 percent year-over-year to JPY 268,389 in

May. The labor cash earnings growth for April was revised to 0.7

percent from a 0.9 percent increase.

Monday, the yen rose 1.06 percent against the euro, 1.13 percent

against the pound, 1.03 percent against the U.S. dollar and 0.05

percent against the Swiss franc.

In the Asian trading today, the yen rose to nearly a 1-1/2-month

high of 98.38 against the Canadian dollar, from yesterday's closing

value of 98.77. The yen may test resistance near the 97.00

region.

The yen advanced to 136.66 against the euro, 192.16 against the

pound and 131.73 against the Swiss franc, from yesterday's closing

quotes of 137.65, 192.73 and 132.43, respectively. If the yen

extends its uptrend, it is likely to find resistance around 131.00

against the euro, 188.00 against the pound and 128.00 against the

franc.

Against the U.S., the Australia and the New Zealand dollars, the

yen edged up to 122.19, 93.66 and 83.10 from yesterday's closing

quotes of 122.52, 94.08 and 83.92, respectively. On the upside,

120.00 against the greenback, 91.50 against the aussie and 82.00

against the kiwi are seen as the next resistance level for the

yen.

Looking ahead, German retail sales for may is slated for release

at 2:00 am ET.

In the European session, Swiss KOF leading indicator for June,

German unemployment rate for June, third estimate of U.K first

quarter GDP, U.K. index of services for April and flash Eurozone

CPI for June and unemployment rate for May are also set to be

announced.

At 4:40 am ET, Reserve Bank of Australia Governor Glenn Stevens

is expected to speak at an event hosted by the Official Monetary

and Financial Institutions Forum in London.

Around the same time, Bank of England's Paul Fisher will deliver

a speech at the Financial Times Future of Insurance event, in

London

In the New York session, Canada GDP for April, U.S.

S&P/Case-Shiller home price index for April, U.S. Chicago PMI

and U.S. consumer confidence, both for June, are set to be

published

At 7:00 am ET, Bank of England Chief Economist Andy Haldane is

expected to speak at the Open University in London.

An hour later, European Central Bank Governing Council member

Ewald Nowotny will give a keynote speech at "Raiffeisen Bank

International-Summer Talk" in Vienna.

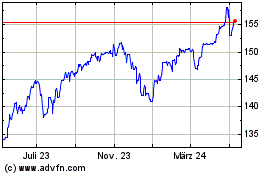

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

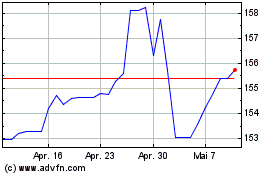

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024