Dollar Extends Gain As Durable Goods Orders Fall In Line With Forecast

26 Mai 2015 - 4:02PM

RTTF2

The U.S. dollar extended its early rally against its major

rivals on Tuesday, as the decline in durable goods orders matched

economists expectation in April, triggering speculation that Fed

may not delay raising its interest rate.

The Commerce Department released a report showing that durable

goods orders dipped by 0.5 percent in April after surging up by a

revised 5.1 percent in March.

The drop in orders came in line with economist estimates, while

the increase in the previous month was upwardly revised from the

originally reported 4.0 percent jump.

Excluding the decrease in orders for transportation equipment,

durable goods orders rose by 0.5 percent in April compared to a

revised 0.6 percent increase in March.

The U.S. new home sales and consumer confidence reports are due

shortly, which could shed more clues about policy outlook.

Traders now focus on the Federal Reserve's monetary meeting on

June 16-17, amid doubts that soft patch of data could prompt Fed

members to wait raising its near zero rates since 2008.

The currency was on firmer footing this week, as Friday's

better-than-expected U.S. inflation data and comments made by Fed

Chair Janet Yellen about interest rates increased expectations of

interest rate normalization.

The greenback strengthened to 123.18 against the yen, a level

untouched since July 2007. The greenback is seen finding upside

target around the 124.00 mark. At yesterday's close, the pair was

valued at 121.54.

The greenback was trading at 0.9496 against the franc, hovering

around early nearly 4-week high of 0.9519. If the greenback

continues its uptrend, 0.96 is possibly seen as its next resistance

level.

The greenback remained firm at an early 4-week high of 1.0884

against the euro, compared to Monday's closing value of 1.0976.

Further uptrend may take the greenback to a resistance surrounding

the 1.08 area.

The greenback extended rally to 1.5360 against the pound, its

strongest since May 8. The greenback is poised to test resistance

around the 1.53 zone. The pair was valued at 1.5466 at Monday's

close.

The greenback spiked up to near a 6-week high of 1.2415 against

the loonie, near 5-week high of 0.7752 against the aussie and a

2-1/2-month high of 0.7254 against the NZ dollar, bouncing off from

its early low of 1.2304, session's low of 0.7839 and a 4-day low of

0.7321, respectively. On the upside, 1.25, 0.77 and 0.72 are seen

as next resistance levels of the greenback against the loonie,

aussie and the kiwi, respectively.

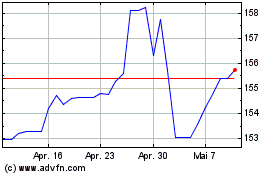

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

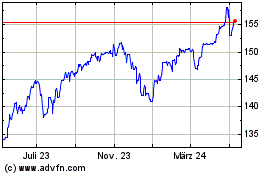

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024