Euro Rises Against Majors

06 Mai 2015 - 8:47AM

RTTF2

The euro strenghened against the other major currencies in the

Asian session on Wednesday, as German bond yeilds rose and

investors await a raft of data from the Eurozone, due shortly.

German 10-year bond yields rose 5 basis point to 0.05 percent,

from the record low of 0.05 percent in April.

German bonds fell as demand for safe-haven assets waned on

speculation that risk of deflation in Eurozone is receding,

offsetting concerns over the situation in Greece. Yeilds move

inversely to prices.

Markit is slated to issue PMI reports for the euro area shortly.

At 5:00 am ET, Eurostat is slated to publish retail sales data.

Traders also await the U.S. jobs data due on Friday, to get

fresh clues about the timing of interest rate hike of the world's

largest economy.

Meanwhile, the safe have currencies - the U.S. dollar and the

yen, have fallen against their major currencies.

The U.S. dollar fell to a 1-week low of 0.7974 againstthe

Australian dollar and a 5-day low of 1.1241 against the euro, from

yesterday's closing quotes of 0.7940 and 1.1184, respectively. The

greenback may test support near 0.81 against the aussie and 1.15

against the euro.

Against the pound, the Swiss franc and the Canadian dollar, the

greenback edged down to 1.5209, 0.9239 and 1.2029 from yesterday's

closing quotes of 1.5178, 0.9263 and 1.2066, respectively. If the

greenback extends its downtrend, it is likely to find support

around 1.55 against the pound, 0.91 against the franc and 1.18

against the loonie.

The yen fell to nearly a 3-month low of 129.75 against the Swiss

franc, a 1-week low of 95.61 against the Australian dollar and a

5-day low of 134.78 against the euro, from yesterday's closing

quotes of 129.31, 95.17 and 134.00, respectively. If the yen

extends its downtrend, it is likely to find support around 135.50

against the Swiss franc, 97.05 against the aussie and 135.50

against the euro.

Against the pound and the Canadian dollar, the yen dropped to

182.42 and 99.69, from yesterday's closing quotes of 181.91 and

99.29, respectively. The yen may test support near 184.65 against

the pound and 100.50 against the loonie.

Tuesday, the euro fell percent 0.13 against the pound, 0.35

percent against the U.S. dollar, 0.57 percent against the Swiss

franc and 0.10 percent against the yen.

In the Asian trading the euro rose to nearly a 2-1/2-month high

of 1.4999 against the NZ dollar, from yesterday's closing value of

1.4787. If the euro extends its uptrend, it is likely to find

resistance around the 1.56 area.

Against the U.S. dollar and the yen, the euro advanced to 5-day

highs of 1.1241 and 134.78 from yesterday's closing quotes of

1.1184 and 134.00, respectively. The euro may test resistance near

1.15 against the greenback and 137.00 against the yen.

The euro climbed to 2-day highs of 0.7390 against the pound and

1.3532 against the Canadian dollar, from yesterday's closing quotes

of 0.7360 and 1.3496, respectively. The euro is likely to find

resistance near 0.75 against the pound and 1.38 against the

loonie.

The euro edged up to 1.0389 against the Swiss franc, from

yesterday's closing value of 1.0359. On the upside, 1.06 is seen as

the next resistance level for the euro.

Looking ahead, PMI reports from major European economies for

April and Eurozone retail sales data for March are due to be

released in the European session.

In the New York session, ADP U.S. private payrolls data and

Canada Ivey PMI - both for April, are slated for release.

At 9:15 am ET, Federal Reserve Chair Janet Yellen and

International Monetary Fund Managing Director Christine Lagarde are

scheduled to participate in a "Finance and Society" conversation

before the Institute for New Economic Thinking Conference on

Finance and Society hosted by the IMF in Washington DC.

At 1:15 pm ET, Federal Reserve Bank of Kansas City President

Esther George participates in a panel on "Credit Markets: Booms,

Busts and Distortions", an event hosted by the International

Monetary Fund, in Washington DC.

After 15 minutes later, Federal Reserve Bank of Atlanta

President Dennis Lockhart is expected to speak on the economic

outlook and monetary policy before a luncheon hosted by the Baton

Rouge Rotary, in U.S.

The Japanese banks will be closed in observance of Constitution

Day holiday.

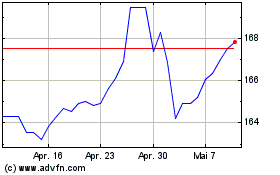

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

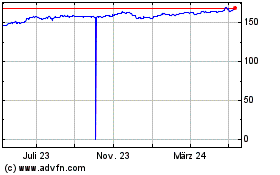

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024