Canadian Dollar Falls As Oil Prices Decline

29 Januar 2015 - 1:18PM

RTTF2

The Canadian dollar declined against its major rivals in

European deals on Thursday, as oil prices continued their sell-off

on concerns over a supply glut following a data showing uptick in

U.S. crude oil inventories last week.

Crude oil for March delivery fell by $0.10 to $44.35 per

barrel.

Weekly report from the U.S. Energy Information Administration

showed Wednesday that U.S. crude oil inventories advanced by 8.9

million barrels in the week ended January 23, while analysts

expected an increase of 3.5 million barrels. As a result, U.S.

crude oil inventories surged to 406.7 million barrels end last

week.

The American Petroleum Institute late Tuesday said crude oil

supplies in the U.S. rose 13 million barrels last week.

The currency was also hurt by decline in European stocks. The

U.S. Federal Reserve indicated that it is on track to raise

short-term interest rates later this year, despite weakness in oil

prices and inflation expectations.

Investors are also concerned about Syriza's pledge to

renegotiate the terms of Greece's €240 billion international

bailout.

The loonie weakened to 1.2562 against the greenback, its lowest

since March 2009, from yesterday's closing value of 1.2534. The

next possible support for the loonie is seen around the 1.264

zone.

The loonie that ended yesterday's trading at 1.4147 against the

euro slipped to a weekly low of 1.4222. Next key support for the

loonie is seen around the 1.43 area.

Survey data from the European Commission showed that the

economic confidence index climbed to 101.2, the highest since July,

from 100.6 in December. It was forecast to rise to 101.6. The

loonie held in lower ranges against the yen, trading at 93.91.

Continuation of the loonie's downtrend may lead it to a support

around the 92.00 region.

Retail sales in Japan rose 0.2 percent on year to 13.524

trillion yen in December, the data from Ministry of Economy, Trade

and Industry showed.

That missed forecasts for an increase of 0.9 percent and was

down from the 0.5 percent gain in November.

On the flip side, the loonie strengthened to a 2-week high of

0.9763 against the aussie. At yesterday's close, the pair was

valued at 0.9883. The loonie may challenge resistance surrounding

the 0.97 mark.

Looking ahead, preliminary German CPI for January, U.S. pending

home sales data for December and U.S. weekly jobless claims for the

week ended January 24 are scheduled for release in the New York

session.

At 11:30 am ET, European Central Bank Executive Board member

Benoit Coeure will take part in a panel discussion on "The future

of Euro" organized by the Innocenzo Gasparini Institute for

Economic Research and Centre for Applied Research at Bocconi

University in Milan, Italy.

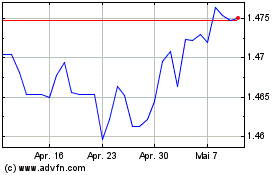

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

Von Apr 2023 bis Apr 2024