NZ Dollar Extends Gains

19 Dezember 2014 - 5:29AM

RTTF2

The NZ dollar extended its gains against the other major

currencies in the Asian session on Friday, as traders consider

Australasian nations as a safe place to invest over the holiday

period following the Swiss National Bank's surprise announcement of

taking rates to negative territory on Thursday.

At an unscheduled meeting on Thursday, the Swiss National Bank

imposed an interest rate of -0.25 percent on sight deposit account

balances at the bank with the aim of taking the three-month Libor

into negative territory. The target range for the three-month Libor

was expanded to -0.75 percent to 0.25 percent.

The SNB reaffirmed its commitment to the minimum exchange rate

of CHF 1.20 per euro, and said it will continue to enforce it with

the utmost determination.

Asian stocks traded higher as investors kept aside worries on

sagging global economy after the U.S. Federal Reserve said it would

remain "patient" in its approach to raise interest rates.

On Thursday, the NZ dollar rose 0.56 percent against the yen and

1.28 percent against the euro.

In the Asian trading today, the NZ dollar rose to nearly a

4-week high of 1.5766 against the euro, from yesterday's closing

quote of 1.5811. If the kiwi extends its uptrend, it is likely to

find resistance around the 1.56 area.

The kiwi, which ended yesterday's deals at 92.18 against the yen

strengthened to a 1-week high of 92.60. On the upside, 93.70 is

seen as the next resistance level for the kiwi.

Against the Australia and U.S. dollars, the kiwi appreciated to

2-day highs of 1.0494 and 0.7786 from yesterday's closing quotes of

1.0510 and 0.7755, respectively. The kiwi may test resistance near

1.045 against the aussie and 0.78 against the greenback.

The Australian dollar rose to 0.8187 against the U.S. dollar in

the Asian session, from yesterday's closing quote of 0.8163. The

aussie is likely to find resistance around the 0.82 area.

Against the yen and the euro, the aussie edged up to 97.49 and

1.5002, from yesterday's closing quotes of 91.01 and 1.5042,

respectively. On the upside, 98.30 against the yen and 1.48 against

the euro are seen as the next resistance levels for the aussie.

Looking ahead, Bank of Japan Governor Haruhiko Kuroda is due to

hold a post meeting press conference at 1:30 am ET. The bank opted

to hold monetary policy unchanged. At 2:00 am ET, German GfK

consumer sentiment index for January and producer price index for

November are due to be released.

In the European session, Eurozone current account data for

October is set to be published.

In the New York session, Canada CPI data for November and retail

sales data for October are due to be released.

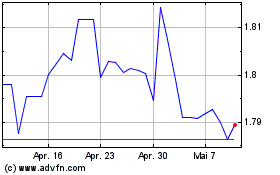

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Apr 2023 bis Apr 2024